#6 - WK45

When Legends Warn: Burry's Billion-Dollar Bet Against AI

Welcome to This Week’s Edition!

Next week in India brings some exciting action to the markets, Lenskart is set to make its debut on the stock exchanges on Monday, November 10th, after raising ₹7,278 crores through its IPO. The eyewear giant will be joined by Groww, expected to list shortly after. Both listings will be closely watched as indicators of investor appetite for India’s consumer tech and fintech sectors in the current market conditions.

In Germany, there’s good news for those working Minijobs. From January 1, 2026, you’ll be able to earn up to €603 per month tax-free. This increase comes as Germany’s minimum wage rises from €12.41 to €13.90 per hour, a welcome change for part-time workers and students managing their finances.

And speaking of wages, Tesla’s board has proposed a jaw-dropping $1 trillion compensation package for Elon Musk. Yes, you read that right, $1 trillion. But here’s the catch: to earn it, Musk needs to grow Tesla’s market cap from its current level to $8.5 trillion through 12 escalating targets starting at $2 trillion, while simultaneously hitting operational milestones like selling 10 million Full Self-Driving subscriptions or deploying 1 million robotaxis. It’s either the most ambitious bet in corporate history or the most unrealistic one.

This week, instead of hunting for opportunities, we’re sounding an alarm, a warning you can’t afford to ignore. When Michael Burry speaks, markets listen, and right now, he’s betting big that something is very wrong in the AI world.

Before we dive in, dein weekly is now on WhatsApp Channel!

I’ve created a WhatsApp channel (not a group) to protect your privacy, your phone number and contact details remain completely private.

Follow the channel for announcements, breaking news, and stories that don’t make it to the weekly newsletter.

Yesterday, I shared 5 essential startup apps for anyone visiting India this December, covering everything from using UPI without an Indian bank account to booking online doctor consultations in India.

Stock Market

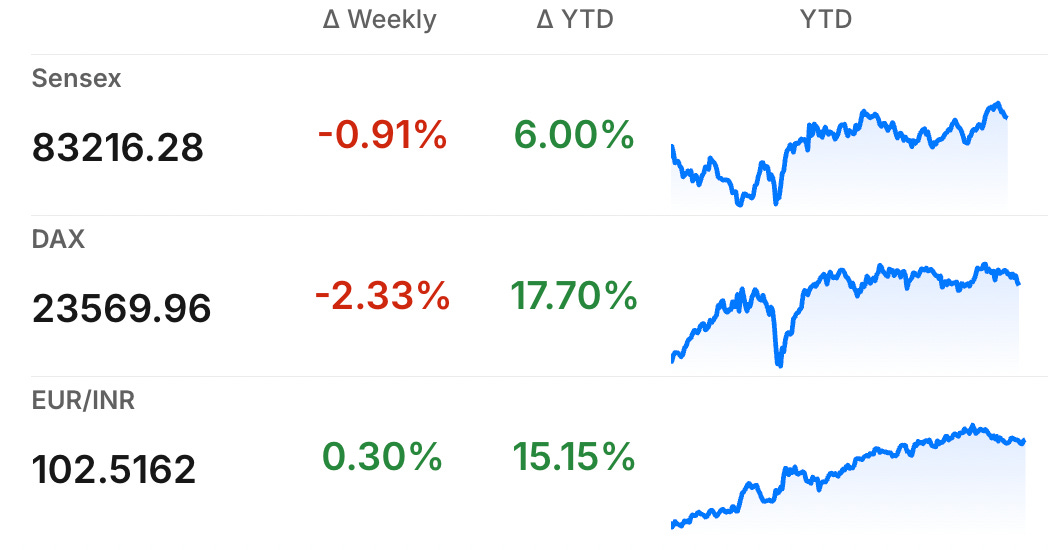

The Sensex closed the week at 83,216 points, down about 0.9% from last week. What’s been weighing down the market? Foreign investors (FIIs) continue to pull money out of India, they’ve now sold over Rs 1.52 lakh crore worth of stocks in 2025 so far. The main reason seems to be that global money is chasing AI-related stocks in the US, China, and Taiwan, and India isn’t seen as part of that AI boom. 1

But here’s the good news, domestic investors (DIIs) are stepping in big time. They bought Rs 5,284 crore just this week, cushioning the fall. In fact, for the first time ever, Indian domestic institutions now own more of the Indian market (18.26%) than foreign investors do (16.71%). This shows that Indian money is confident about India’s long-term story. 2

Germany’s DAX had an even tougher week, falling 2.3% to close at 23,570 points on Friday. This was the lowest level since late September. The big worry in European markets? Tech stock valuations, especially AI-related companies, are looking stretched and investors are getting nervous. Add to that ongoing uncertainty about the US government shutdown and general economic concerns, and you get a market that’s feeling cautious. 3

Germany News Roundup

German Nurse Jailed for Killing Ten Patients in Wuerselen, Court deemed crimes ‘particularly severe’; evidence shows sedatives and painkillers used during Dec 2023–May 2024 night shifts, with exhumations probing additional victims. - India Today

Girocard Introduces New Sound for Contactless Payments, Merchants may opt in via a simple terminal software update, with major retailers already adopting the audiovisual confirmation across millions of German accounts. - Merkur

Kaufland Launches Telemedicine Clinics Inside Supermarkets, offering video GP consultations supported by Sana Kliniken medical staff in a Mosbach pilot, accessible to publicly and privately insured patients and potentially scalable nationwide. - n-tv

Hyundai Expands Rüsselsheim Test Campus with €150M, aiming to refine European-market models using indoor labs, charging infrastructure, driving simulators and an electromagnetic chamber, while boosting regional R&D headcount and capabilities. - Hessenschau

Rheinmetall Breaks Ground on Lithuanian Ammunition Plant, creating a €300 million, 340-hectare facility due 2026 to produce tens of thousands of 155mm shells annually, add a propellant centre, and generate about 150 local jobs. - Rheinmetall

Germany Enacts Carbon Capture Legal Framework, expected to unlock €30–50 billion in CO2 storage and pipeline investments over the next decade, covering unavoidable industrial emissions. - GTI

India News Roundup

India Urges Creation of Big, World-Class Banks, Sitharaman said the government is consulting the RBI and lenders, urging system-driven lending, deeper industry credit, and infrastructure-focused capex to unlock a GST-driven investment cycle. - The Hindu

India Launches Heaviest Ever Communication Satellite, weighing 4,410 kg and sent by an upgraded LVM3, CMS-03 underscores India’s expanding launch capabilities and supports its upcoming crewed and lunar ambitions. - Yahoo News

NITI CEO Sees Indo‑US Trade Progress by November, and confirmed the National Manufacturing Mission launching month-end to boost capacity, attract foreign investment and reinforce India’s role as a global growth pole. - ETV Bharat

India, Germany Deepen Renewable Energy Partnership, focusing on technology exchange, solar and wind showcases, green hydrogen demos, Agri‑PV pilots, and investment facilitation under the GSDP framework. - ETEnergyWorld

NRI News Roundup

Top NRE FD Rates for NRIs in 2025, show IndusInd at 7% and most major banks at 6.5–6.6% for one-year tenures, with tax-free interest and full repatriation. - Newsd

Opportunity

Michael Burry, the investor who famously predicted the 2008 housing market crash and was portrayed by Christian Bale in the movie “The Big Short”, is making headlines again, but this time with a stark warning about artificial intelligence stocks. His hedge fund, Scion Asset Management, has placed a massive $1.1 billion bet against two of the AI sector’s biggest darlings: Nvidia and Palantir. These aren’t traditional short positions; Burry bought put options on 1 million Nvidia shares (worth $187 million) and 5 million Palantir shares (worth $912 million). This means if these stocks drop significantly, he stands to make a fortune. His cryptic warning on social media, “Sometimes, we see bubbles” has sent shockwaves through the market, with both stocks falling sharply after the news broke.

When the man who predicted the 2008 crash bets $1.1 billion against AI giants Nvidia and Palantir, it’s not noise, it’s a warning worth hearing. Sometimes the best investment move is knowing when not to play.Why should we pay attention? When someone with Burry’s track record makes such a bold contrarian move, it’s worth pausing to think. Nvidia recently hit a staggering $5 trillion market cap, and Palantir is trading at a price-to-earnings ratio exceeding 400 - levels that suggest expectations are sky-high. While Palantir’s CEO Alex Karp has dismissed Burry’s bet as “crazy,” arguing these companies are making real money, the reality is that valuations have run far ahead of fundamentals. Cloud revenue growth from tech giants is slowing despite massive AI investments, and there are early signs that AI chip demand might be cooling. This doesn’t mean AI isn’t the future. It absolutely is, but it’s a reminder that even great companies can be terrible investments if you buy them at the wrong price. For investors holding AI stocks or planning to buy, this is a clear signal to be cautious, avoid chasing hype, and remember that bubbles can deflate faster than they inflate.

Read more about this at Times of India

Watchlist (IN)

While everyone’s watching airline stocks take off with record plane orders, the smarter money might be quietly flowing into a different corner of aviation, India’s precision component manufacturers. Air India and IndiGo have ordered close to a thousand aircraft between them over the last couple of years, numbers that rival entire national fleets. But here’s the thing: these planes aren’t being built in India; they’re rolling off assembly lines at Boeing and Airbus facilities abroad. What is happening in India, though, is something more significant for long-term investors, a growing ecosystem of listed companies manufacturing critical aircraft components that go into every plane these global giants produce.

Value Research has spotlighted six such companies that are part of the global aerospace supply chain, supplying precision parts to OEMs like Boeing, Airbus, and others. These aren’t your typical high-profile stocks; they’re the quiet manufacturers making everything from avionics displays to structural components that keep aircraft flying safely. Airbus alone is now sourcing over $1 billion worth of components from more than 100 Indian suppliers and plans to double that to $2 billion by 2030. Companies like Unimech Aerospace, Samtel Avionics, and others in this space are moving beyond basic manufacturing into higher-value areas like design, engineering, and system integration. If you want to ride India’s aviation boom without the volatility and thin margins of airline stocks, this is where the real opportunity lies. Head over to Value Research’s detailed analysis to discover which six companies made their watchlist and why they believe this sector is primed for growth. 4 5

Until Next Sunday…

That’s a wrap for this week! From Sensex and DAX corrections to Michael Burry’s billion-dollar warning against AI stocks, and the hidden opportunity in India’s aviation component manufacturers, this week reminded us that the smartest investors don’t always follow the crowd. Sometimes the best opportunities are in the companies quietly supplying the picks and shovels rather than those doing the mining.

As always, if you found value in this week’s newsletter, please share it with your friends, family, and colleagues. The best support you can give us is helping spread these insights to others who might benefit from them. Knowledge grows when shared!

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel