#4 - WK43

Diwali Optimism, Berlin Bridges, and Gold Opportunities

This week felt like the world shifting gears — quite literally in Europe, where daylight saving time ended last night. As you read this Sunday morning, clocks have already fallen back an hour. Those darker evenings are now here, a subtle reminder that winter is knocking at the door.

During the week, Indian Commerce and Industry Minister Piyush Goyal’s visit to Berlin made meaningful headlines. His meetings with German industry leaders and government officials focused on deepening bilateral trade, technology partnerships, and green manufacturing ties. For us investors and professionals with a foot in both worlds, this could open new corridors for collaboration, especially in renewable energy and high-tech sectors.

Back home in India, the festive spirit was in full swing earlier this week. Diwali brought the usual glow to streets, buzz to markets, and optimism in the air. Traditionally, this period also sees renewed energy in Indian markets, with investors taking fresh positions for the new Samvat year that follows.

Stock Market

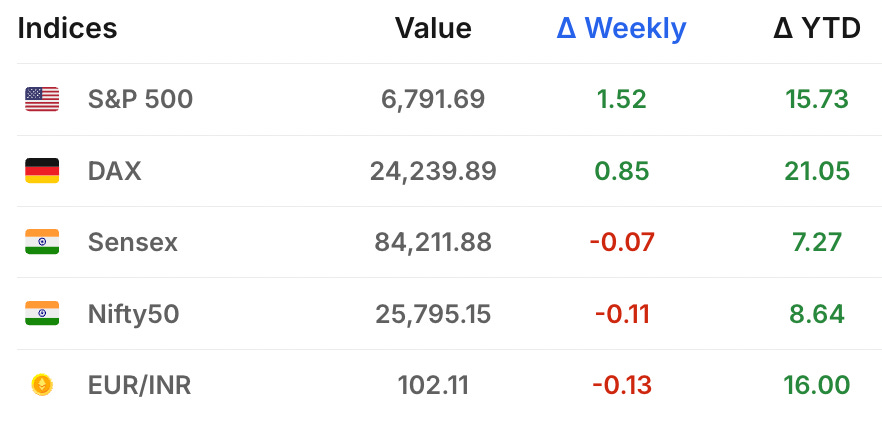

The German DAX had a solid week, closing at 24,239.89 points on Friday, marking a weekly gain of 0.85% . The index showed resilience despite mid-week volatility, with Monday starting at 24,035.19 and climbing steadily to touch a weekly high of 24,384.24 on Tuesday.

Indian markets ended Week 43 on a cautious note, with both Sensex and Nifty falling around 0.4% on Friday after profit booking kicked in.

Germany News Roundup

VW Secures Production Despite Chip Crisis ensuring uninterrupted vehicle manufacturing across German and European plants next week amid ongoing supply challenges from chipmaker Nexperia. - Heise.de

Lufthansa Pilots’ Strike Increasingly Likely as union talks collapse over pension disputes, raising concerns for passengers amid ongoing labor conflicts within the airline group. - n-tv

Startups Transform German Defense Industry, introducing rapid innovation in drone and AI technologies, fueled by rising military budgets and venture capital investments amid evolving security threats. - n-tv

Merz Defends Large-Scale Deportations in Germany stating public safety concerns despite widespread criticism and political backlash over divisive immigration rhetoric. - The Guardian

German Chancellor Advocates Single EU Stock Exchange to enhance market unity, liquidity, and investor interest, keeping European firms’ value creation within the region and boosting competitiveness globally. - The Trade News

Mercedes-Benz Paid Severance to 4,000 Employees saving billions by offering generous packages including six-figure sums to long-time and mid-career staff for early voluntary departure plans. - Autojosh

TKMS Debuts on Frankfurt Stock Exchange marking its independence and advancing its position as Europe’s leading maritime defense provider with a record €18.6 billion order backlog and strong growth ambitions. - TKMS

Airbus, Thales, Leonardo Merge to Counter Starlink forming a European space powerhouse with 25,000 employees and €100+ million synergies, aiming to compete globally against Elon Musk’s dominant satellite broadband service. - CNBC

Driving in Germany to Cost More from 2026 due to new Euro 7 emission standards, insurance hikes, mandatory digital emergency calls, and higher CO₂ taxes impacting nearly all motorists. - Meinbavria

India News Roundup

Diwali 2025 Sales Soar to Rs 6.05 Lakh Crore with 87% of consumers favoring Indian products, driven by a 25% surge in local goods and a thriving non-corporate retail sector, signifying strong trade growth and job creation. - Business Today

India Proposes IT Rules to Combat Deepfakes mandating AI and social media firms to clearly label AI-generated content amid rising online deepfake concerns to ensure transparency and accountability. - Marketscreener

IndiGo Orders 30 More Airbus A350 Jets boosting its fleet to 60 A350s to expand international long-haul routes with efficient, modern aircraft supporting India’s global aviation growth ambitions. - Airbus

Zoho Launches UPI App Zoho Pay targeting India’s digital payments sector with integrated chat and payments features, set to compete with major players like PhonePe and Google Pay. - India Today

NRI News Roundup

NRI Taxation on Indian Equity Gains Explained, capital gains from Indian listed shares are taxed as LTCG, STCG, or business income based on holding period and classification, with DTAA benefits possible for NRIs in Germany. - Livemint

Piyush Goyal’s official visit to Germany

The visit marked the 25th anniversary of the India–Germany Strategic Partnership and aimed to deepen cooperation in trade, investment, technology, and sustainable industries. Below is the chronological timeline of visit.

Wednesday, October 23

Met German Federal Minister Katherina Reiche to discuss trade, green energy, technology, and the India–EU FTA progress.

Held bilateral talks with Dr. Levin Holle (German Chancellery’s Economic Advisor & G7/G20 Sherpa) on economic cooperation.

Met Xavier Bettel (Deputy PM of Luxembourg) to discuss bilateral trade and Luxembourg’s upcoming state visit to India.

Chaired a CEO Roundtable with German Mittelstand (SME) leaders at the Indian Embassy, focusing on investment opportunities in India.

One-on-one meetings with CEOs: Mercedes-Benz (EVs & green mobility), Infineon (semiconductors), Schaeffler (automotive & AI), Renk (defense), Herrenknecht (infrastructure), and Enertrag (renewable energy)

Thursday, October 24

Met with Federation of German Industries (BDI) on industrial collaboration.

Bilateral lunch with Valdis Dombrovskis (EU Commissioner) — reaffirmed commitment to finalize India–EU FTA.

Met René Obermann (Airbus Chairman) on aerospace manufacturing in India.

Participated in Berlin Global Dialogue 2025 panel: “Growing Together – Trade and Alliances in a Changing World.” Delivered India’s message: “We don’t do trade deals with a gun to our head.”

Friday, October 25

Meetings with German Industry Associations, follow-up sessions to explore joint investments in semiconductors, defense, and green energy

Engaged with the Indian diaspora in Berlin, calling them catalysts for deeper India–Germany ties

Summary :

The three-day visit consolidated India’s economic and strategic partnership with Germany. While no agreements were formally signed, it deepened dialogue on the India–EU FTA, green technology, and manufacturing collaborations — reinforcing India’s stance as a confident and strategic trade partner.

Opportunity (IN)

Gold crossed ₹1.2 lakh per 10 grams this Diwali — a new milestone that made many of us think twice before buying physical jewelry or coins. But here’s the thing: you don’t need to buy physical gold to benefit from its price appreciation. There are smarter, more convenient ways to add gold to your portfolio, especially if you’re managing investments remotely from Germany1

Simple Options to Invest in Gold for NRIs:

1. Gold ETFs (Exchange-Traded Funds)

These are the most liquid and transparent option. Gold ETFs track the domestic price of gold and trade on stock exchanges like regular stocks. You can buy or sell them anytime during market hours through your demat account. Popular options include Nippon India Gold BeES (which commanded 53% market share during Diwali week2), ICICI Prudential Gold ETF and Kotal Gold ETF. 3

2. Gold Mutual Funds (Fund of Funds)

If you don’t have a demat account or prefer SIP investing, gold mutual funds are ideal. These funds invest in Gold ETFs on your behalf. Top performers include SBI Gold Fund, HDFC Gold ETF Fund of Fund, and Kotak Gold Fund. You can start with as little as ₹1,000 and set up monthly SIPs to rupee-cost-average your gold purchases. 4 5

Watchlist (IN)

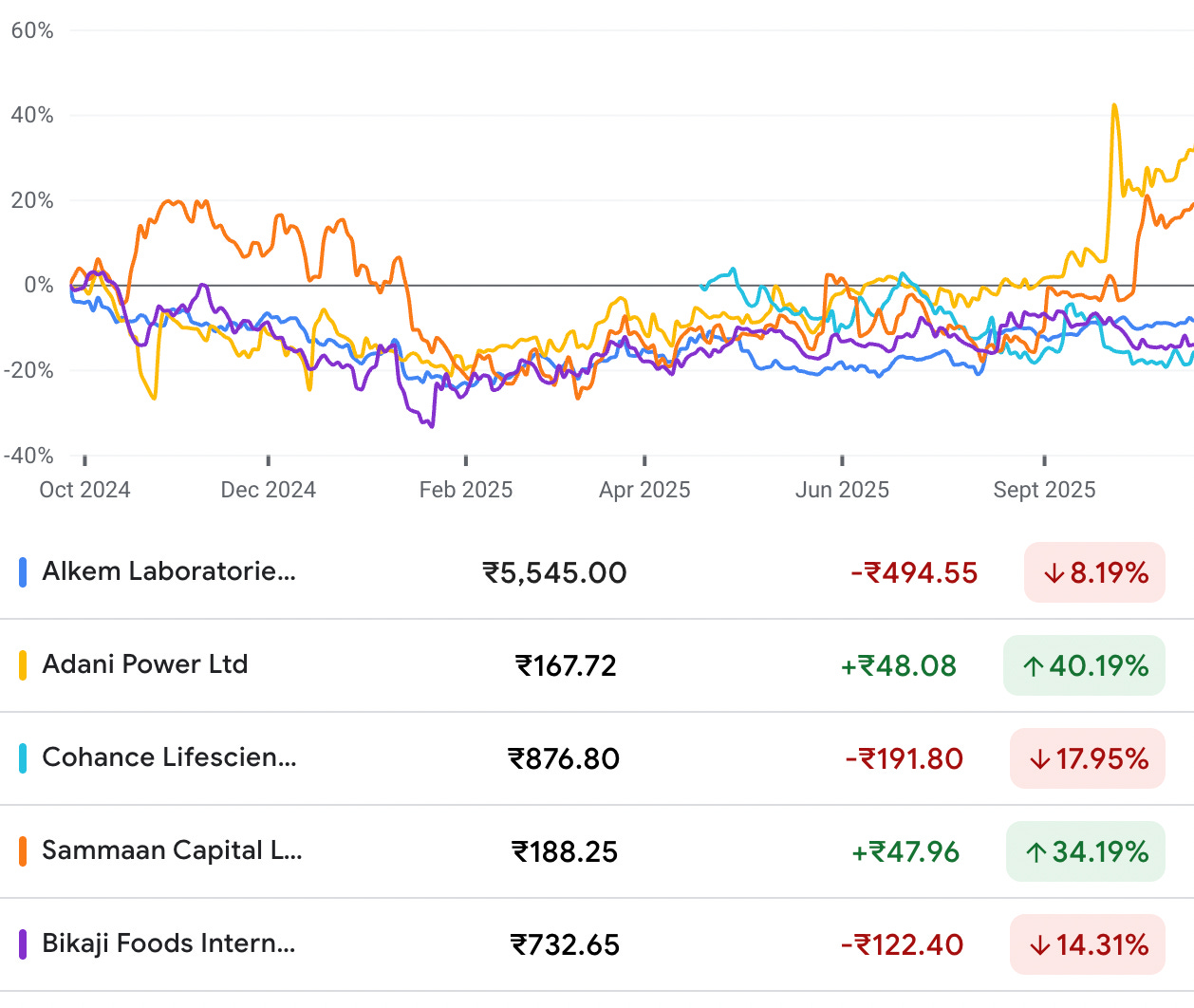

When India’s largest mid-cap fund makes fresh bets, it’s worth paying attention. HDFC Mid-Cap Opportunities Fund, managing over ₹84,000 crores, recently added five interesting stocks to its portfolio in September 2025. These additions give us a peek into where seasoned fund managers see value in today’s market.

The Five Fresh Picks:

1. Alkem Laboratories (Pharma)

A leading domestic pharmaceutical company, Alkem has been expanding its product portfolio and strengthening its presence in chronic therapies. With India’s healthcare spending rising and generic drug demand staying strong, pharma remains a defensive yet growth-oriented sector.

2. Adani Power (Power Generation)

Despite sector volatility, Adani Power has been building capacity and securing long-term power purchase agreements. The fund’s bet here likely reflects confidence in India’s rising electricity demand and the company’s operational improvements.

3. Cohance Lifesciences (Specialty Chemicals)

This specialty chemicals player serves pharma and agrochemical industries. The company has been gaining traction in export markets, and the fund’s aggressive position enhancement suggests strong growth visibility.

4. Sammaan Capital (NBFC)

A relatively newer addition to fund portfolios, Sammaan Capital operates in the micro-finance and small business lending space. With credit penetration still low in rural India, the fintech-enabled NBFC sector offers interesting long-term potential.

5. Bikaji Foods International (FMCG - Snacks)

The popular ethnic snacks maker has been scaling up distribution and expanding beyond its North Indian base. With organized snacking gaining market share and festival demand strong, branded food companies remain attractive.

Should You Follow :

Remember, mutual funds operate with different time horizons, risk profiles, and diversification rules than individual investors. These stocks are worth researching further, but they shouldn’t be blindly copied into your portfolio. What makes them interesting is the sectoral themes they represent - healthcare, power, specialty chemicals, financial inclusion, and branded foods, all aligned with India’s long-term growth story.

Until Next Sunday…

If you’ve made it this far, thank you. Your time is valuable, and I’m glad you spent part of your Sunday morning with me. If something here sparked an idea, answered a question, or just helped you stay informed, please share this newsletter with your friends, WhatsApp groups, or LinkedIn network.

Word-of-mouth is how this community grows, and every share helps me reach more friends navigating life between Germany and India.

Got feedback or topics you’d like covered? Hit reply — I read every email.

See you next Sunday,

Jimit Patel