#14 - WK01

The Year of New Beginnings

Happy New Year!

As we kick off the first edition of 2026, there’s plenty to feel optimistic about. The year ended on a milestone note for India overtook Japan to become the world’s fourth-largest economy with a GDP of $4.18 trillion. Only the United States, China, and Germany stand ahead now, and if things continue on this trajectory, India is eyeing the third spot within the next 3-4 years.

So what do the experts think about markets in 2026? The predictions are cautiously optimistic for both our focus regions. For Germany’s DAX, Berenberg Bank expects the index to move higher through mid-2026, targeting the 25,500-26,200 range after already crossing their 24,000 forecast for end-2025.

On the Indian side, Morgan Stanley has laid out three scenarios for the Sensex in 2026. Their base case, which they give a 50% probability sees the Sensex reaching 95,000 by end-2026, a solid 13% upside from current levels, assuming stable macro conditions and continued private sector investment. The bull case is even more exciting at 107,000, though that depends on favorable global conditions including lower oil prices and supportive policies.

Beyond the usual market action, 2026 might also bring something we’ve been watching closely for three years, a potential end to the Russia-Ukraine conflict. Ukrainian President Zelenskyy announced on New Year that a peace agreement is “90% ready,” with high-level diplomatic meetings scheduled throughout early January.

If peace materializes, it opens up massive reconstruction opportunities in sectors ranging from infrastructure and construction to energy and engineering, areas where German expertise shines. We’ve dedicated this week’s opportunity section to exploring what a Ukraine peace deal could mean for European markets and where the smart money might flow.

On the other side of the world, a large-scale U.S. military strike in Venezuela that resulted in the capture of President Nicolás Maduro. Following months of escalating pressure, U.S. Special Forces (Delta Force) apprehended Maduro and his wife, Cilia Flores, at the presidential palace in Caracas. Both were immediately transported to New York to face federal drug-trafficking charges, while President Donald Trump announced that the United States would "run the country" until a safe transition to a new government can be established.

Stock Market

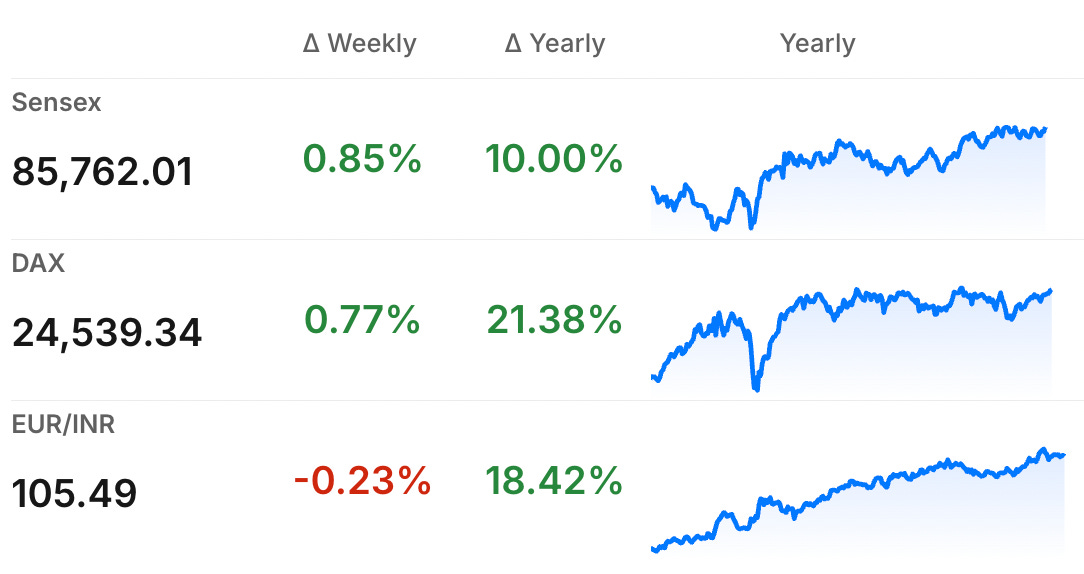

Indian markets had a positive start to 2026 after a sluggish end to the previous year. The Sensex moved from around 85,041 on December 26 to close at 85,762 on January 2, gaining approximately 721 points or about 0.85% for the week. Banking and auto stocks led the rally, with Nifty Bank hitting a new record high during the week.

The DAX closed 2025 on a strong note at 24,490 and continued its momentum into 2026. The index rose to around 24,500-24,524 in the first trading session of 2026, staying near its October record highs. This week’s modest gain came after an impressive 23% rise throughout 2025, marking the best annual performance since 2019. Defense and aerospace stocks were the top performers this week as geopolitical tensions and expectations of higher military spending continue to support the sector.

The Euro-Rupee exchange rate remained relatively stable during the week, hovering in the 105-106 range.

Germany News Roundup

Merz Sees 2026 as Germany’s New Beginning, highlighting challenges from war, economy, and reforms while expressing confidence in future prosperity through resilience and policy changes. - DW

Germany Struggles Digitally Behind Peers, digital public services lag due to bureaucracy, reliance on outdated methods and fragmented federal structure lacking nationwide solutions and coordination. - DW

German Economy Faces Decline Amid High Costs, leading to investor flight, significant job cuts, and record insolvencies in major industries during 2025 and 2026 forecasts. - Merkur

Germany Expands Industrial Ties with Kazakhstan, enhancing cooperation through new projects, technologies, and investments in mechanical engineering to foster long-term strategic growth and market access in Central Asia. - DKNews.kz

A freight car transporting hazardous materials derailed near Rosenheim, causing extensive damage to railway tracks and parked vehicles. The closure of parts of the line towards Austria is expected to last weeks due to costly repairs. - DW

Tesla plans to increase production capacity at its Grünheide factory, near Berlin in 2026 despite weak local sales. The factory currently serves over 30 markets and may start producing battery cells as part of future expansions. - Reuters

Bulgaria will join the eurozone on January 1, 2026, becoming its 21st member. Political instability and public concerns over inflation have lowered support for the adoption of the euro. - BBC

India News Roundup

India Rises as World’s Fourth-Largest Economy, marking a significant achievement with $4.18 trillion GDP but facing challenges in widespread prosperity and per capita income growth amid large population and job market issues. - GKToday

India Advances Rare Earth Magnet Manufacturing, with a 7,280 crore scheme to build 6,000 MTPA domestic capacity boosting electric mobility, renewables, defence, and self-reliance while reducing import reliance and supporting long-term industrial growth. - PIB

Bangladesh Recalls High Commissioner from India, to Dhaka for urgent consultations amid recent developments in bilateral relations with India, according to diplomatic sources. - Newsonair

India Advances Electronics Manufacturing with ECMS Tranche, approving 22 projects with ₹41,863 crore investment, expected to create 33,791 direct jobs and boost self-reliance across key electronic component sectors nationwide. - PIB

Key Personal Finance Changes in India for 2026, will affect credit card fees, loan rules for gold and silver, new SEBI mutual fund regulations, income tax revisions, BSBD improvements, faster cheque clearing, two-factor authentication, and updated economic measures. - Upstox News

Top 5 Indian AI Startups Transforming Industries, are raising billions and innovating in healthcare, language models, and customer service with strong government backing and global venture capital interest. - BusinessOutreach

Opportunity

Russia-Ukraine Peace Deal and Reconstruction

Where Do We Stand on Peace Talks?

The start of 2026 brings cautious optimism as Ukrainian President Volodymyr Zelenskyy announced in his New Year address that a peace agreement is “90% ready”. Multiple high-level meetings are scheduled in early January. While Russia continues to push for territorial concessions and uncertainties remain, the diplomatic momentum suggests 2026 could be the year when reconstruction moves from planning to actual implementation. 1

The Money on the Table

The financial commitments for Ukraine’s reconstruction are substantial and already allocated. Germany has approved its 2026 budget with €11.5 billion specifically earmarked for Ukraine, the largest amount since the invasion began. Beyond immediate military aid, the European Union has established the “Ukraine Facility,” a dedicated mechanism providing up to €50 billion in support from 2024 to 2027 for recovery, reconstruction, and modernization efforts. 2 3

Which Sectors Will Benefit?

If peace materializes, several sectors stand to gain significantly from Ukraine’s reconstruction, which experts are calling “one of the largest infrastructure undertakings in modern history”.

Construction and Infrastructure: The most obvious beneficiary will be the construction sector, as Ukraine needs to rebuild roads, railways, bridges, schools, hospitals, and residential housing.

Energy and Renewables: Russia’s systematic targeting of Ukraine’s energy infrastructure means the entire grid needs rebuilding.

Engineering and Heavy Machinery: From gearboxes to heavy equipment, the reconstruction will require massive amounts of machinery and engineering expertise.

Defense Industry (Short-term): Interestingly, even with peace, the defense sector will remain relevant in the near term as Ukraine builds security guarantees and NATO-style protections.

Banking and Financial Services: International financial are providing billions through various mechanisms, creating opportunities in the financial services sector supporting reconstruction.

In the coming editions of this newsletter, we’ll dive deeper into each of these sectors, examining specific companies, investment vehicles, and strategies to participate in what could be one of Europe’s defining economic opportunities of the decade. Stay tuned as we explore how you can potentially benefit from Ukraine’s reconstruction story.

Until Next Sunday…

As we navigate this new year, remember that being an investor isn’t about catching every single wave, but about being on the right beach when the big one hits. With India now the 4th largest economy and peace talks potentially unlocking a massive European reconstruction era, 2026 is shaping up to be a year of “The Great Rebuilding”. Whether it’s physical infrastructure in Ukraine or digital infrastructure in India, the theme is clear: value is moving toward tangible, long-term growth.

Next week, we will kick off our “Deep Dive” series on the reconstruction sectors, starting with German Engineering & Heavy Machinery.

Wishing you all a wonderful start to 2026.

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel