#12 - WK51

The Week Before Christmas

Welcome to Week 51.

There are a few things one quietly assumes will never change in Germany: Sundays stay peaceful, Deutsche Bahn will somehow still be late, and Volkswagen will never shut down a factory on its home turf. Yet this week, one of those assumptions broke, as VW confirmed the closure of a German plant.

As we count down to Christmas with just one week remaining, Europe’s automobile industry received welcome news as the EU scaled back its 2035 ban on combusion vehicles, now requiring only 90% of new cars to be zero-emission rather than 100%.

Meanwhile, thousands of farmers converged on Brussels this week with tractors, protesting the EU-Mercosur trade deal they fear will flood European markets with cheaper South American agricultural products, resulting in tense clashes with police near the European Parliament.

In the edtech sector, Coursera and Udemy announced a landmark $2.5 billion merger, combining two major online learning platforms to address the surging global demand for AI skills training in an evolving workplace landscape.

On the diplomatic front, Prime Minister Modi embarked on a significant three-nation tour to Jordan, Ethiopia, and Oman, strengthening India’s strategic partnerships across West Asia and Africa. Rahul Gandhi traveled to Germany during the same period, engaging with lawmakers and the Indian diaspora in Berlin, though the visit drew criticism from the BJP. Read more about both diplomatic visits in this week's newsletter.

Stock Market

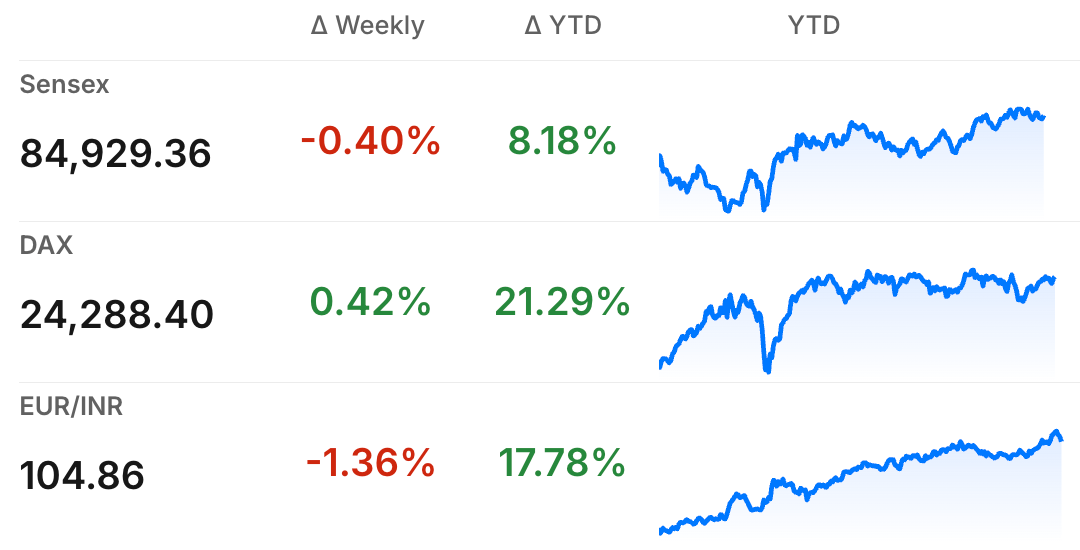

The Indian stock market had a tough week, with the Sensex dropping from around 85,268 points on December 12 to 84,929 points by December 19 - a decline of roughly 400 points or about 0.4%. The index broke a four-day losing streak on Friday with a 469-point gain, but it wasn’t enough to recover the week’s losses.

The German market had a positive week with the DAX closing at 24,288.40, marking a weekly gain of 0.42%. The index showed resilience after some mid-week volatility, with Friday's session seeing a strong 0.40% gain. Leading the Friday rally were Commerzbank, MTU Aero Engines, and Bayer.

The rupee strengthened against the Euro this week, gaining approximately 1.3% against the Euro during the week.

Germany News Roundup

Volkswagen Ends Production at Dresden Plant, after 24 years, shifting focus to AI, robotics, and research amid economic challenges and tariff impacts in Germany and global markets. - Economic Times

Germany’s State Debt Surges to 68%, The deficit ratio nearly doubles to 4.8%, marking a peak since reunification, prompting calls for fiscal reform by Bundesbank Chief Joachim Nagel. - Telepolis

Ford Abandons Big EV Plans, Impacting Cologne, shifting focus to combustion and hybrid cars with a $19.5 billion cost, causing uncertainty and job cuts at the Cologne plant amid a strategic partnership with Renault for affordable EVs. - Express

Germany’s Mittelstand Doubts Economic Revival, as confidence in government policies, infrastructure, and fiscal programs sharply declines, with only 39% expecting growth turnaround compared to 62% in spring, reveals DZ Bank survey. - TradingView

Germany Launches €30 Billion Investment Fund, aimed at mobilizing private capital to drive energy transition, technology, and industrial modernization across key sectors including startups and SMEs. - Global Banking and Finance Review

Germany Foils Islamist Christmas Market Attack Plot, authorities arrested five suspects planning a vehicle attack on a southern Bavaria Christmas market, preventing a potential Islamist-motivated terror incident during the festive season. - Le Monde

Germany Launches Pension Accounts for Children, introducing Frühstart-Rente with guaranteed state contributions to modernize private pensions and encourage early savings for future retirement. - Qazinform

EU Revises 2035 Car Emissions Ban, switching from a full combustion engine ban to a 90% emissions reduction target to balance industry support with climate goals amid EV adoption challenges. - New Era Live

India News Roundup

India's Greatest Strategic Challenge in Bangladesh, involves shifting political dynamics, increased Chinese and Pakistani influence, and risks losing strategic space in Dhaka without timely recalibration post-1971 liberation war. - The Hindu

India Targets 300 Products to Boost Russia Exports, seeking to increase shipments in engineering, pharma, agri, and chemicals to narrow the $59 billion trade deficit and tap $100 billion trade potential by 2030. - Economic Times

Apple Eyes iPhone Chip Assembly in India, facilitating local chip packaging talks with Indian manufacturers, signaling progress in India's semiconductor sector and potential supply chain diversification for Apple by 2026. - Times of India

Lok Sabha Passes Controversial VB-G RAM G Bill, guaranteeing 125 days of rural employment but sparking opposition protests over renaming MGNREGA and concerns about increased central control and state financial burden. - Illustrated Daily News

Alang Shipbreaking Yard Faces Decline, due to fewer retired ships, costly compliance, and competition from neighboring countries, severely impacting local economy and employment in the world’s largest ship recycling hub. - Al Jazeera

PM Modi’s Three-Nation Tour: Jordan, Ethiopia & Oman (Dec 15-18, 2025) 1 2 3

Jordan (Dec 15-16)

First bilateral visit in 37 years, coinciding with 75th anniversary of diplomatic relations

5 MoUs signed covering renewable energy, water resource management, cultural exchange (2025-2029), Digital Public Infrastructure (DPI), and twinning arrangement between Petra and Ellora

Bilateral trade target: $5 billion over next 5 years

India-Jordan Business Forum held in Amman

Jordan to join International Solar Alliance

Proposal for UPI-Jordan digital payment system integration

Cooperation focus areas: defence, counter-terrorism, fertilizers, agriculture, renewable energy, and tourism

Ethiopia (Dec 16-17) 2

First-ever PM visit to Ethiopia

8 MoUs signed establishing Strategic Partnership, covering customs cooperation, data centre at Ethiopian Foreign Ministry, UN Peacekeeping training, debt restructuring under G20, ICCR scholarships, and AI training courses

Focus on easing customs regulations to boost bilateral trade

Infrastructure cooperation including data centre push

Strengthened Global South partnership

Oman (Dec 17-18)

Second visit to Oman, marking 70 years of diplomatic relations

Historic signing of India-Oman Comprehensive Economic Partnership Agreement (CEPA) - the biggest outcome

6 additional agreements/MoUs: Maritime Heritage & Museum, Agriculture & Allied Sectors, Higher Education, CII-Oman Chamber of Commerce cooperation, Joint Vision Document on Maritime Cooperation, Executive Programme for millet cultivation

Enhanced defence cooperation including joint exercises and maritime security

Rahul Gandhi’s Germany Visit (Dec 15-20, 2025) 4 5

Key Engagements

Duration: 5-day visit from, accompanied by Indian Overseas Congress (IOC) Chairperson Sam Pitroda

BMW Visit (Munich): Toured BMW Welt and BMW manufacturing plant; highlighted TVS-BMW 450cc motorcycle partnership as “proud moment for Indian engineering”

Hertie School Address (Berlin): Delivered speech on democracy, leadership, and global responsibility; emphasized “Democracy is not merely a system of government - it is a constant process of engagement, responsibility and accountability”

Meeting with Olaf Scholz: Held luncheon meeting with former German Chancellor to discuss global affairs, trade, and India-Germany relations

Indian Diaspora Engagement (Dec 17, Berlin): Addressed ‘Connecting Cultures’ event organized by Indian Overseas Congress; met IOC presidents from across Europe to discuss NRI issues, strengthening Congress party, and IOC’s role

German Think-Tanks: Engaged with various German think-tanks on India’s trajectory in changing global landscape

Opportunity

AI Semiconductors and Quantum Computing ETF

DasInvestment published an article about AI semiconductors and quantum computing ETF, which could be an interesting sector for long-term investment consideration.

Global X launched a new ETF on November 25, 2025, the AI Semiconductor & Quantum ETF (ISIN: IE0000ZL1RD2), that focuses on four key areas: AI semiconductors, processing systems, data center infrastructure, and quantum computing technologies. What caught my attention is the relatively low cost structure with a Total Expense Ratio (TER) of just 0.35%. This makes it cheaper than similar products from VanEck (0.55%) and WisdomTree (0.5%) that were launched earlier this year.

The numbers behind this sector are quite compelling. McKinsey estimates the quantum computing market could reach up to $130 billion by 2040, while Boston Consulting Group projects an even more ambitious economic value of up to $1 trillion by 2035. These aren’t small numbers, and they show why major asset managers are launching products in this space.

However, it’s important to understand that we’re talking about cutting-edge technology here. Quantum computers work fundamentally different from regular computers - they use “qubits” instead of traditional bits, which allows them to process information exponentially faster. This technology is still in development and commercial maturity is expected to take several years. This means higher volatility and potential price swings should be expected.

For more detailed information about this ETF and the underlying technology, visit the full article on DasInvestment’s page.

Until Next Sunday…

And just like that, we’re down to the final four days before Christmas. The streets are lit up, markets are buzzing with last-minute shoppers, and that familiar end-of-year feeling is in the air. It’s been quite a week, from major political visits spanning three continents to corporate announcements that could reshape entire industries.

Whether you’re staying put or traveling to be with family, I hope you get some well-deserved downtime. We’ll be back in the new year with more updates on what’s happening across markets, policies, and everything in between. Until then, enjoy the festivities, stay warm, and if you’re traveling – safe journeys!

Merry Christmas and see you in 2026!

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel

Really solid roundup. The parallel timing of Modi's three-nation tour and Rahul Gandhi's Germany visit is intresting, feels like two competing visions of India's global engagement playing out simulatneously. One thing I noticed working with Indo-German trade networks is how often the diaspora engagement piece gets undervalued compared to official state visits, but the Berlin outreach could matter more long-term for grassroots economic ties.