#1 - WK40

Defence Stocks Rise, IPOs Heat Up, and GIFT City Opens to NRIs

Welcome to first edition of DEIN Weekly,

Where we bring curated insights on finance, economy and investments from Germany and India.

Markets around the world are reacting to some big moves: in Germany, the government is rolling out a major fiscal stimulus, loosening its long-standing “debt brake” to fund defense and infrastructure projects. This shift is already creating ripples across the DAX and bond markets. Meanwhile, in India, the IPO scene is buzzing again, with over US$8 billion worth of offerings expected before year-end — a clear sign that investor sentiment is picking up.

As ever, for Indians in Germany, the intersection of both economies offers unique opportunities — especially in cross-border finance, defense, and funds structures that straddle both markets.

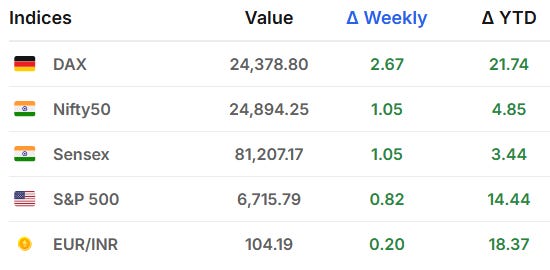

The Scorecard

This week, Germany’s stock market had a good run, gaining around 2.5%. Investors seemed confident thanks to hopes of US interest rate cuts that could boost markets by year-end. Several big companies, especially in industrials and healthcare, saw strong gains.

India’s markets also had a positive week, with both the Nifty 50 and Sensex rising close to 1%. Banks and metal stocks led the gains, supported by strong buying from local investors. Foreign investors were a bit cautious, selling selectively, but overall the mood stayed upbeat due to steady economic support from government policies.

These quick snapshots show both markets holding steady with optimism for more growth soon

Germany News Roundup

Kretinsky Exits Thyssenkrupp Steel : Billionaire Daniel Kretinsky withdraws from Thyssenkrupp Steel, returning his 20% stake and paving the way for Jindal Steel’s takeover, promising investment in emission-friendly steel production in Germany. - RP Online

German Unemployment Hits 14-Year High : Unemployment in Germany has surged to its highest level in 14 years amid economic uncertainty and delayed stimulus from Friedrich Merz. Growth is expected but long-term prospects remain shaky. - Politico

VW Halts Production in Saxony : VW suspends production in Zwickau and Dresden from October 6 due to weak EV demand. Saxony’s premier demands €100M research funds and job guarantees; VW offers €1.5M over seven years, rejecting further negotiations. Business Insider

Turkish EV Maker Togg Enters German Market : Turkish automaker Togg launches affordable EVs in Germany with prices under €40,000, challenging VW and Tesla. Models offer advanced features, safety, and up to 623 km range, but limited local service network. - Merkur

Belgium Residency via Investment : Belgium offers residency and citizenship through business investment, requiring €350,000–€500,000 over five years, allowing eventual citizenship with benefits like visa-free travel and EU freedom of movement. - Business Today

Rheinmetall’s $444M NATO Ammo Order : Rheinmetall secured a $444 million US contract to produce NATO-standard artillery ammunition for a secret Eastern European country, likely Ukraine, with production starting in 2026 and delivery by mid-2027 amid geopolitical tensions. - Merkur

Germany invests €35bn in military space systems : Germany will invest €35 billion by 2030 in military space capabilities, focusing on satellites, communication, and cyber security to enhance NATO and EU security amidst rising tensions with Russia and China. - Defence24

India News Roundup

India Plans 100% FDI in Insurance : Finance Minister Nirmala Sitharaman may introduce the Insurance Amendment Bill in the Winter session to allow 100% FDI in India’s insurance sector, aiming to boost investment, policyholder benefits, and economic growth. - Time of India

India’s RBI Sets Ethical AI Framework : RBI formed the FREE-AI committee to develop ethical AI guidelines in finance, addressing bias, transparency, and accountability amid increasing AI use in banking and payments, aiming to set standards for broader AI governance in India. - Economic Times

Key Finance Changes Effective October 1, 2025 : From October 1, 2025, India implements major financial updates including NPS equity options, IRCTC Aadhaar booking, faster cheque clearance, bank fee revisions, Tata Motors demerger, and updated pension charges impacting daily finance and investments. - Upstox

WeWork IPO Subscribed 4% Day 1 : WeWork India’s IPO got 4% subscription on first day, with retail investors at 14%. The Rs 3,000-crore issue ends Oct 7, valued at Rs 8,685 crore. Funds go to selling shareholders as it’s an offer for sale. - Realty

India Extends Algo-Trading Deadlines : India’s SEBI extends deadlines for retail algorithmic trading rules, requiring brokers to register and test strategies by early 2026 to ensure secure participation and compliance with new regulatory standards.

NRI News Roundup

Financial Checklist for NRIs Returning to India : NRIs planning to return to India should settle credit card dues, secure job offers before moving, manage bank accounts per Indian laws, consider renting before buying property, and update financial and estate plans to avoid tax issues and ensure a smooth transition. - Money Control

Top 7 Banks for NRI FDs : Seven Indian banks offer attractive NRI FD interest rates, with IndusInd Bank leading at 7% for 1-year FDs. Most others like Kotak, HDFC, ICICI, Axis, SBI, and public sector banks offer around 6.6%. - Informalnewz

Opportunities

Germany’s Defense Build-Up and Financing Shift

Germany is undergoing a bold transformation in its defense sector. In recent years—accelerated by the war in Ukraine—it has loosened strict borrowing rules and created a special “Sondervermögen” fund to enable large defense and infrastructure investments without breaching constitutional limits. 1

The scale of commitment is staggering: over the next five years, Germany plans to spend about €649 billion on defense, aiming to more than double current levels. 2 The 2025 budget is already set at ~€95 billion, with the figure projected to rise to €162 billion by 2029. 1 Key priorities include aerospace, missile systems, drones, satellite and space-defense capabilities. For example, Germany has earmarked €35 billion for space-related defense through 2030. 2

Berlin is also pivoting away from U.S. dependence on arms. Recent defense procurement plans (154 major acquisitions between 2025–2026) favor European suppliers, with only ~8% slated from U.S. firms. 3 Nevertheless, execution risks remain: Germany’s defense procurement has historically been slow and bureaucratic. 4

1 - Atlantic Counsil / 2 - Defence News / 3 - Euronews / 4 - Chatam House

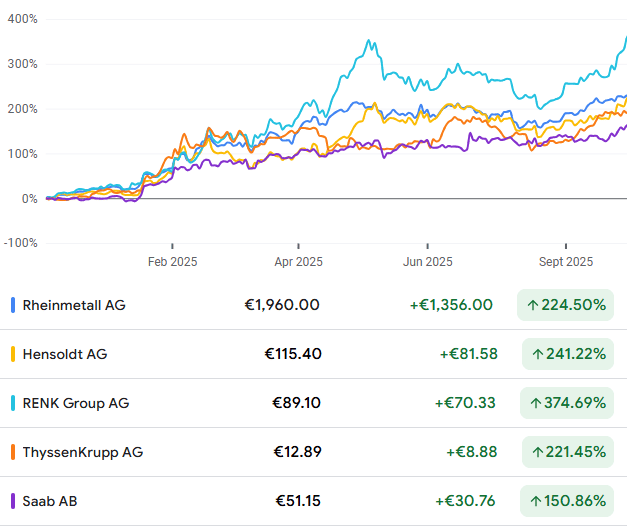

Why this matters for investors: As Germany leans into defense innovation, opportunities will emerge across aerospace, missile tech, satellite systems, drones and dual-use tech (cyber, AI, sensor systems). Companies that can integrate civilian and defense applications or partner across borders stand to gain. We compared* the year-to-date performance of major defense companies — Rheinmetall, Hensoldt, Renk, Thyssenkrupp, and Saab AB to understand how market valuations reflect ongoing defense expansion.

Watchlist

Indian Defence Stocks Gearing Up for the Next Growth Phase

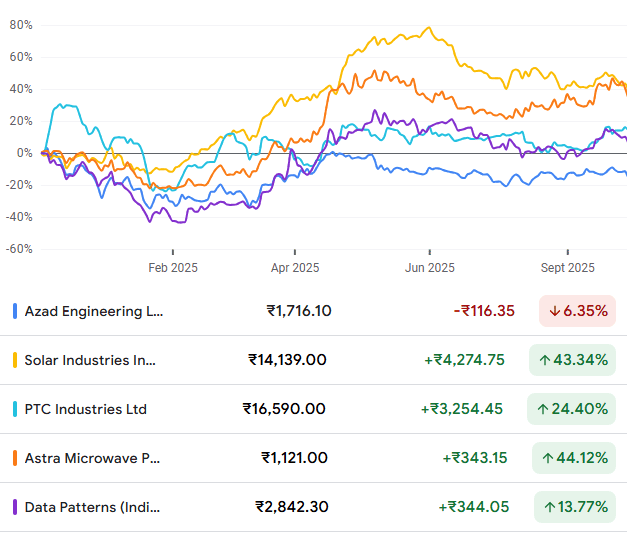

The Nifty India Defence Index has delivered exceptional performance with +28.3% returns year-to-date (2025), significantly outperforming the Nifty 50. India’s defense budget increased to ₹6.81 lakh crore for FY 2025-26, supporting the “Atmanirbhar Bharat” (self-reliant India) initiative.

Goldman Sachs has spotlighted Azad Engineering, Solar Industries, PTC Industries, Astra Microwave, and Data Patterns as high-potential Indian defence companies.

Gift City

GIFT IFSC is gaining real momentum as a gateway for NRIs & diaspora capital. According to IFSCA, diaspora investments into GIFT City-based funds have already crossed ₹60,998 crore (≈ US$7 billion), with about 5,000 NRIs participating. The fund ecosystem is also expanding: registrations of fund management firms and funds have surged, and the total commitments & Assets under Management are showing strong growth.

Spotlight: Tata India Dynamic Equity Fund — A Game Changer for NRIs

Tata Asset Management has launched the Tata India Dynamic Equity Fund at GIFT City, with a minimum entry of just $500 — the lowest among India-linked offshore funds. Designed for NRIs and retail investors, it allows direct participation in India’s equity growth story through a tax-efficient route. This launch marks a major shift as GIFT City transitions from being an institutional hub to a retail-friendly investment gateway, enabling smaller investors to benefit from India’s expanding capital markets without complex compliance or high entry barriers.

Conclusion

As we end this week’s newsletter, a few upcoming events deserve your attention. The India-EU FTA negotiations resume in Brussels from October 6–10, which could influence trade and market access. In Germany, the government’s increased spending on defense and infrastructure may reshape capital flows and industrial priorities. Back home, India’s expected IPO surge may open doors to fresh investment opportunities, while regulatory updates and tax incentives in GIFT City continue to make it an attractive hub for NRIs.

Stay tuned — the next few quarters may bring structural shifts rather than just cyclical moves.