#9 - WK48

Clicks, Glühwein & Copper Deficits

Welcome to Week 48.

This week, the world seemed to move at two speeds - frenzied and festive.

Black Friday kicked off the global shopping season with Americans alone spending a record $8.6 billion online by early evening, choosing cozy couches and smartphones over braving the cold to queue outside stores. The numbers told the story of how we shop now: mobile devices drove 58.6% of all purchases, and for the first time, AI shopping assistants helped hundreds of thousands navigate deals, ask questions, and build personalized buying guides. Globally, the 24-hour shopping bonanza generated $74.4 billion in online sales, a 5% jump from last year.

While bargain hunters were online, Germany was preparing for something more traditional. Christmas markets across the country began opening their doors this week, filling town squares with the smell of Glühwein, roasted almonds, and gingerbread. From Nuremberg’s iconic Christkindlesmarkt to smaller neighborhood gatherings in Berlin, Munich, and Cologne. For those of us who’ve lived in Germany, these markets are as much about community as commerce, a reminder that some experiences still belong firmly offline.

Halfway across the world, India celebrated a different kind of milestone. Ahmedabad was officially awarded hosting rights for the 2030 Commonwealth Games, marking the first time a single Indian city will host the multi-sport event. With investments already flowing into stadiums, transport, and hospitality, the next five years will reshape Ahmedabad’s urban landscape in ways that echo what we’ve seen in other cities post-Games.

But not all this week’s news was celebratory. Ethiopia’s Dofan volcano erupted in the Afar region, sending lava flows and ash clouds into the sky and forcing thousands to evacuate. The eruption, one of several along the East African Rift this year, was a stark reminder of how geological forces continue to shape lives and livelihoods in vulnerable regions.

As we close out Week 48, these stories “consumerism and tradition” , “ambition and crisis” paint a picture of a world that’s constantly recalibrating. Let’s dive into what happened in markets, policy, and business this week.

Stock Market

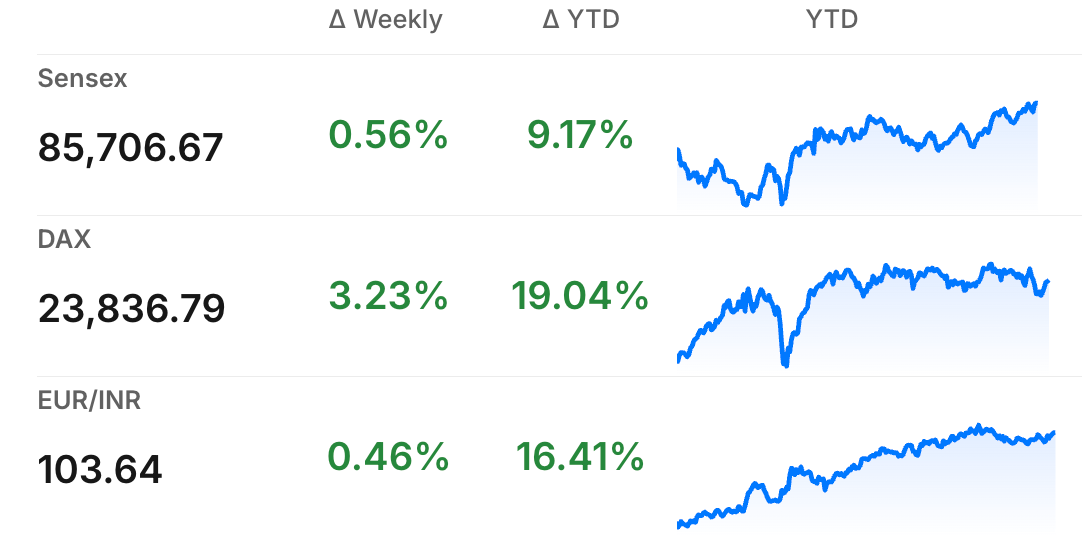

The Indian markets had a rollercoaster week, swinging between gains and losses before ending slightly positive. The Sensex started the week around 85,231 points, dropped to 84,587 on Monday amid selling pressure, but then bounced back strongly on Wednesday with a 1,022-point jump. By the end of the week, the index settled around 85,706, showing resilience despite ongoing volatility.

Sector-wise, IT stocks like Infosys , Tech Mahindra and Wipro were the bright spots, gaining ground as the sector showed strength. On the flip side, metals, realty, and pharma stocks dragged the indices lower, with names like JSW Steel , Bharat Electronics , and Tata Steel among the week’s losers.

German markets had a much better week, with the DAX posting gains for four straight sessions. The index climbed from around 23,464 at the start of the week to close near 23,836 by Friday. The positive mood was driven by two main factors: growing expectations that the US Federal Reserve will cut interest rates in December, and renewed hopes for an end to the war in Ukraine.

Germany News Roundup

German Parliament Approves Debt-Heavy 2026 Budget, allocating over €180 billion in new debt to boost investments, defence, and Ukraine aid amid economic revival efforts and relaxed debt rules. - Global Banking and Finance Review

Ford Cologne Starts Job Cuts Friday, laying off thousands with severance acceptance beginning at noon, employees received details in a recent meeting. - Kölner Stadt-Anzeiger

Rheinmetall Staff Protest Automotive Division Sale, highlighting demands for secure work conditions amid uncertainties from the proposed divestiture as the company shifts focus to defense manufacturing. - RP Online

Germany Hydrogen Economy Set to Double by 2032, expanding rapidly with new government incentives, large-scale projects, and major investments driving growth in green hydrogen production and infrastructure development. - OpenPR

Germany’s Christmas Markets Open Under Tight Security, offering traditional festive treats and crafts while enhanced anti-terrorism measures ensure visitor safety amid past tragic attacks. - NBC News

Mass Protests Ahead of AfD Youth Wing Launch, the far-right AfD plans to launch a new youth wing amid 50,000 expected protesters in Giessen, raising concerns over extremist ties and democratic values in Germany. - Yahoo News

India News Roundup

Ahmedabad to Host 2030 Centenary Commonwealth Games, signifying India’s landmark role in Commonwealth sport while featuring 15-17 sports and celebrating the centenary with cultural vibrancy and global athletic unity. - Commonwealth Sport

India-China Tensions Flare Over Arunachal Pradesh, a recent incident involving alleged harassment of an Indian from Arunachal Pradesh highlights ongoing disputes over territorial claims and visa legitimacy between the two nations. - Al Jazeera

India Economy Surges 8.2% Despite Tariffs, accelerating growth driven by manufacturing, construction, and domestic consumption amid U.S. tariffs and GST cuts, with GDP outpacing forecasts and robust domestic conditions expected to sustain growth. - CNBC

India Seeks Five More S-400 Squadrons from Russia, to enhance air defence with upgraded missile stocks and MRO facilities amid geopolitical balancing between Russia and the US. - Times of India

India Eyes US Trade Deal Closure by Year-End, expecting to finalize the first tranche despite tariff challenges and aiming to boost bilateral trade to $500 billion by 2030. - Times of India

India’s New Labour Codes Reshape Workforce, consolidating 29 laws into four codes to streamline compliance, extend benefits to gig workers, and alter salary structures with mixed impacts on job security and take-home pay. - Finshots

Reliance to Build $11bn AI Data Centre in Visakhapatnam, aiming for a 1GW capacity campus by 2030, partnering with Brookfield and Digital Realty to boost India’s AI infrastructure and digital ecosystem. - Yahoo Finance

NRI News Roundup

Indian Diaspora Demands Dual Citizenship Rights, to enhance global stature, economic influence, and security for over 3.5 crore NRIs, urging government action for transformative diaspora engagement and national growth. - New Indian Express

Opportunity

Why Raw Materials Are the Foundation of Tomorrow’s Economy

If you’ve been following headlines about electric vehicles, AI data centers, or renewable energy, you’ve probably heard the buzzwords. But here’s what often gets missed: none of these technologies work without raw materials. No copper, lithium, nickel, or rare earth metals means no energy transition, no EVs, and no AI boom.

The numbers tell a compelling story. Global demand for critical metals is expected to grow at 4.5% annually through 2035, with energy transition materials driving more than half of that growth. Copper demand alone could double by 2040 because every electric vehicle, charging station, wind turbine, solar panel, and data center needs significant amounts of it. Battery metals like lithium are projected to see demand jump 126% between 2025 and 2030. 1 2

Here’s where it gets interesting for investors: supply isn’t keeping up. Mining companies underinvested in new projects over the past decade when commodity prices were low. Now, with demand surging, we’re heading into structural deficits. UBS recently raised its copper deficit forecast for 2025 to 230,000 tonnes and expects it to nearly double to 407,000 tonnes in 2026, four times what they predicted earlier. For lithium, analysts expect a shortfall of 572,000 tonnes by 2034, requiring $116 billion in new investments by 2030 just to meet EV targets. 3 4

Think of it this way: it takes 10-15 years from discovery to production for a major copper mine. Even if companies started digging tomorrow, the supply crunch will persist well into the 2030s.

This classic supply-demand mismatch creates a favorable environment for rising prices. Copper prices need to stay above $10,000 per tonne to incentivize new mine development, and with current prices near $11,000, the market is already pricing in these supply constraints. 5

Germany is at the heart of Europe’s energy transition, heavily investing in renewables, grid infrastructure, and electric mobility. The country’s new infrastructure spending push will consume massive amounts of raw materials. Investing in commodity-focused funds gives you exposure to this structural shift without needing to pick individual mining stocks.

Watchlist

German financial publication DAS INVESTMENT recently analyzed the best-performing commodity equity funds over the past three years. These funds focus on mining stocks (companies that extract and process raw materials), giving investors direct exposure to rising commodity prices.

Some of the standout performers

AGIF Allianz Global Metals and Mining

Bakersteel Global Funds Electrum Fund

Earth Exploration Fund UI

Visit Das Investment for complete list and more information.

What makes these funds attractive right now? Despite strong recent gains, many underlying commodity stocks remain attractively valued compared to the tech sector. With structural demand drivers in place: electrification, AI infrastructure, renewable energy buildout and supply struggling to catch up, the fundamental case for commodities remains intact for the medium to long term.

A word of caution: Commodity funds can be volatile, especially when tied to cyclical industries like mining. These are best suited for investors with a 3-5 year horizon who believe in the energy transition story and can stomach short-term price swings. For those investing from Germany, check if your broker offers these funds and review the TER (total expense ratio) before committing.

Until Next Sunday…

As November closes, December brings a few important markers worth keeping on your radar.

In India, e-commerce platform Meesho is reportedly preparing for its much-anticipated IPO, which could be one of the largest Indian tech listings since Zomato and Nykaa in 2021. The company, which focuses on tier-2 and tier-3 cities and has become a favorite among small sellers and budget-conscious shoppers, will test investor appetite for consumer internet businesses after a two-year dry spell. If priced right, this could open the door for other unicorns waiting on the sidelines.

On the geopolitical front, Russian President Vladimir Putin is expected to visit India in early December for bilateral talks with Prime Minister Modi. The visit comes at a sensitive time, with the Ukraine conflict still ongoing and Western pressure on India to reduce its reliance on Russian oil and defense equipment. For markets, watch how this plays out, India has walked a careful diplomatic line, maintaining ties with both Moscow and Washington, and any announcements around trade, energy deals, or defense cooperation could have implications for rupee-dollar dynamics and commodity flows.

As always, if you found value in this week’s newsletter, please share it with your friends, family, and colleagues. The best support you can give us is helping spread these insights to others who might benefit from them. Knowledge grows when shared!

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel