#8 - WK47

Pensions, Prices, and Portfolios

Welcome to Week 47. This week in Germany, a heated debate has erupted over the government’s new pension reform plans (known as “Rentenpaket II”). In simple terms, the government wants to guarantee that retirees continue to receive at least 48% of the average wage until 2039. To fund this, they plan to increase the pension contributions deducted from your monthly salary.

However, young political leaders, specifically from the “Junge Union” (youth wing of the CDU/CSU) are fiercely opposing this. They argue that this deal unfairly burdens the younger working population, who will be forced to pay significantly higher contributions today without a guarantee that the system will be sustainable when they retire.

On a positive note, starting January 2026, many people in basic utility contracts will see noticeable relief on their electricity and gas bills. According to comparison portal Verivox, around 113 regional basic suppliers have announced electricity price cuts averaging 9%, which translates to savings of about €161 per year for a household consuming 4,000 kilowatt-hours annually. The reductions are primarily driven by government subsidies for grid fees, which suppliers are passing on to customers.

On November 18, Cloudflare suffered a major global outage lasting several hours, affecting popular services like X, OpenAI, and Anthropic. The culprit? A bug in their Bot Management feature that consumed excessive CPU resources and brought down core network traffic worldwide. This comes after we’ve seen similar outages from Amazon’s AWS and Microsoft’s Azure in recent times. The reality is sobering: just a handful of massive cloud and content delivery providers essentially run the internet’s backbone, and when one of them goes down websites, apps, and critical services across the globe can grind to a halt within minutes. It’s a stark reminder of how concentrated and vulnerable our digital infrastructure has become.

Stock Market

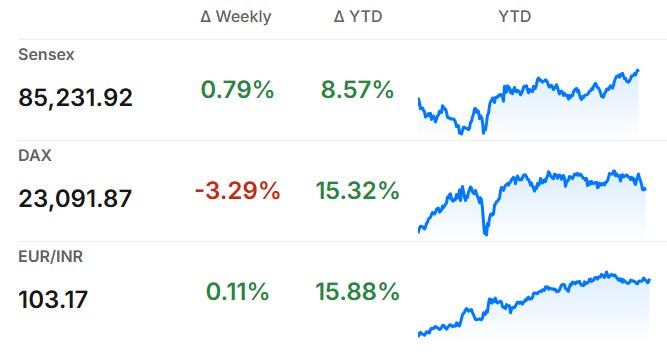

This was a solid week for Indian markets. The Sensex added 669 points, rising 0.79% to close at 85,231, its highest weekly close since September 2024. The index is now just 1% away from its all-time high. Banking and financial stocks led the gains, with several major banks hitting strong numbers. For the year so far, the Sensex is now up about 9%.

The DAX had a rough week, falling 3.29% to close around 23,090. The index dropped from a high of 23,512 earlier in the week to its lowest point at 22,943 on Friday. Major German companies across energy, technology, and banking sectors pulled the index down as concerns about slowing manufacturing growth continued. Despite this weekly drop, the DAX is still up around 15% for this year overall.

Germany News Roundup

MAN Cuts 2300 Jobs Amid Auto Industry Decline, as Germany’s automotive sector loses nearly 50,000 jobs due to global pressures, high costs, and increased competition, impacting multiple key industrial areas. - heise.de

Deutsche Bahn Faces Worsening Railway Infrastructure Crisis, with aging network, increased construction, and declining punctuality projected to continue impacting passengers and operations in coming years. - Aviation.Direct

SPD Proposal Threatens Purchase on Account, potentially disrupting German online commerce by introducing postal confirmation and waiting periods, risking consumer convenience and market stability. - Eulerpool

Bosch Faces Production Issues Amid Chip Relief Hopes, the company continues to struggle with manufacturing delays despite anticipated improvements in semiconductor supply. - Autonews

Pension Dispute Threatens Germany’s Coalition Stability, as young conservative MPs oppose costly pension guarantees, risking legislative deadlock and highlighting generational financial burdens in Germany’s aging population. - The Guardian

Stuttgart 21 Rail Project Delayed Again, postponed beyond December 2026 due to digital signaling system issues and other challenges, Deutsche Bahn has yet to set a new opening date. - DW

Parfümerie Pieper Files for Insolvency Protection, continuing all operations with over 120 stores open and wages secured for three months during restructuring efforts under self-administration. - wn.de

India News Roundup

India’s Trade Deficit Hits Record $41.68 Billion, driven by soaring gold imports and falling exports amid US tariffs, worsening trade balance in October 2024. - Economic Times

India-Germany Strengthen Defence Partnership, focusing on co-development, military cooperation, and Germany’s participation in major multinational exercises in 2026. - PIB

India Considers Lifting Ban on Rheinmetall AG, this move signals potential renewal of defense cooperation, including a prospective multi-billion Euro submarine deal enhancing India-Germany strategic ties. - Times Now News

Reliance Retail Brings Essence Cosmetics to India, partnering with Germany’s cosnova to distribute Europe’s top makeup brand exclusively across key Indian beauty stores and expanding its footprint in the beauty sector. - Storyboard18

NRI News Roundup

Submit SIR Enumeration Form Online Now, to participate in India’s Special Intensive Revision of voter lists by filling and submitting forms digitally if not received physically, with guidelines for NRIs and others. - Onmanorama

Best Term Life Insurance For NRIs in 2025, offers affordable, flexible policies ensuring global coverage, easy online purchase, and financial security for families in India with tax benefits and strong regulation. - SugerMint

Opportunity

Rheinmetall held its Capital Markets Day on November 18, 2025, unveiling an ambitious roadmap that positions the company as Europe’s leading defense contractor. Here’s why this presents a compelling investment opportunity for readers.

Rheinmetall expects sales to grow from €9.8 billion in 2024 to approximately €50 billion by 2030, representing over 5x growth in just six years.

The Big Picture

Europe is rearming at an unprecedented scale. Germany alone plans to increase defense spending from €50.2 billion in 2024 to approximately €180 billion by 2030, aiming to meet NATO’s 3.5% GDP target. This massive spending increase stems from real security concerns, Danish defense intelligence warns of potential regional conflict in the Baltic within two years and large-scale European war within five years.

What They’re Building

The company is investing over €8 billion in the next five years to expand capacity across five key segments with sales target by 2030

Vehicle Systems (€13-15 billion target)

Weapon and Ammunition (€14-16 billion target)

Air Defense (€3-4 billion target)

Digital (€8-10 billion target)

Naval (€5 billion target)

Why This Matters for Investors

The investment case is straightforward: guaranteed government demand, multi-year contracts with €350 billion in German commitment appropriations beyond 2035, and industry-leading profitability growth. Rheinmetall maintains strong balance sheet discipline with planned dividends of €8.10 per share for 2024 (expected to rise further) while investing aggressively in growth.

With European security concerns escalating and governments committed to long-term rearmament, Rheinmetall stands at the center of a historic defense spending cycle that’s just beginning.

Watchlist (IN)

Warren Buffett’s Berkshire Hathaway filed its Q3 2025 portfolio update in mid‑November, and there were a few interesting shifts compared to last quarter.

Berkshire opened a new position in Alphabet worth around 4–4.3 billion dollars, making it roughly the 10th‑largest holding in the portfolio right away.

At the same time, Berkshire continued trimming two of its long‑time giants, Apple and Bank of America, reducing both stakes further.

Berkshire also fully exited its position in homebuilder D.R. Horton, which had been a relatively new bet in the housing space.

If interested, checkout Morningstar article for all changes made in Q3 2025.

Until Next Sunday…

Looking ahead, the next begins with SPS Nuremberg (November 25–27), Europe’s largest industrial automation and smart manufacturing exhibition, where over 1,000 exhibitors will showcase everything from robotics to AI‑driven factory systems. If you’re interested in the digital transformation of German manufacturing, or simply wondering how our factories will keep pace with global competition, this event might be for you.

As always, if you found value in this week’s newsletter, please share it with your friends, family, and colleagues. The best support you can give us is helping spread these insights to others who might benefit from them. Knowledge grows when shared!

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel

Wow, the Cloudflare outage part really stood out. It's truly insightful how you connect these incidents, highlighting our critical global digital infrastructure dependencies. Thank you for this comprehensive update; it clearly underscores the systemic risks involved and how fragile things can be.