#7 - WK46

Chips, Climate & Coalitions

Welcome to This Week’s Edition!

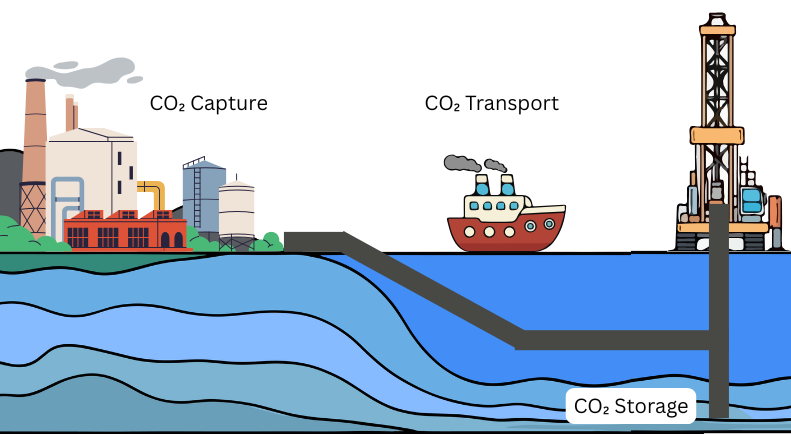

After 43 days, the longest in U.S. history - the American government shutdown finally ended when President Trump signed the funding bill on November 12. While Washington was sorting itself out, Germany made a historic move of its own. The parliament approved a groundbreaking carbon storage law allowing CO₂ to be captured from industrial facilities and stored permanently under the seabed. This isn’t just environmental policy. It’s a €30-50 billion investment opportunity unlocking decades of infrastructure buildout in cement, steel, and chemicals. More on this in opportunity section.

Closer to home in India, the political landscape solidified further as the BJP-JDU alliance swept the Bihar Assembly Elections with decisive margins. The victory reinforces the Modi-Nitish partnership and suggests continued policy stability heading into 2026, something markets generally appreciate.

Amid all this, a development that might seem small but has wide-reaching effects made headlines: Dutch semiconductor company Nexperia resumed chip deliveries after resolving recent supply chain issues. Given how critical chips are for everything from cars to consumer electronics, this return to normalcy is a relief for global and particularly European manufacturing.

Stock Market

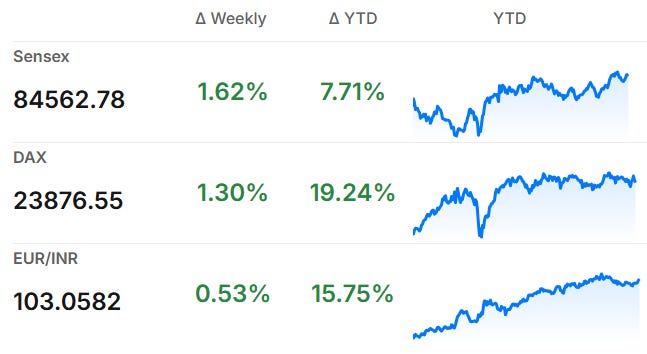

The Sensex moved up slightly this week, closing around 84,563 points after some ups and downs during the trading days. Even though technology stocks put some pressure on the market, strong buying at the end of the week helped the index finish in the green. Most sectors were mixed: banking and finance stocks did well while IT and consumer brands saw some selling.

The DAX in Germany saw minor losses this week and ended lower around 23,876 after reaching 24,425 points, which is the lowest level in a week. The market was affected by concerns about the global economy, especially worries about expensive technology stocks and big investment plans linked to artificial intelligence. Some companies like Siemens Energy performed well, but losses in Bayer and Commerzbank pulled the index down. Despite the week’s drop, the DAX is still much higher than it was one year ago, suggesting underlying strength in Germany’s largest companies.

Germany News Roundup

Google to Invest $6 Billion in Germany, to expand data centers near Frankfurt and Hanau, boosting infrastructure and AI innovation in Europe’s largest economy. - The Economic Times

Germany Introduces Voluntary Military Service, aiming to recruit 20,000 volunteers by 2026 with mandatory physical tests for all 18-year-old men starting 2027 while keeping conscription (compulsory military service) optional. - DW

Germany’s Budget Committee Approves 2026 Plan, with 8 billion euros more debt, boosted investments, increased defense spending, and additional Ukraine aid to stimulate economic recovery. - Yahoo Finance

Major Disruption at Cologne Central Station, trains disrupted until Nov 24 as Deutsche Bahn upgrades signaling technology, delayed by software errors, causing widespread rerouting and cancellations. - WAZ

India News Roundup

India Advocates Equitable Climate Finance at COP30, emphasizing fairness and urging developed countries to honor climate commitments while showcasing its leadership in renewable energy and emission reduction efforts. - Times of India

Reliance to Build 1-Gigawatt AI Data Center, to enhance AI infrastructure in Andhra Pradesh, joining major investments by Google, Microsoft, and Amazon in India’s growing tech market. - Yahoo Finance

Indian Banks Shift to Secure ‘.bank.in’ Domain, to enhance cybersecurity and reduce online banking scams by ensuring only RBI-verified institutions use this exclusive domain, improving customer protection in digital transactions. - Upstox

DHL Plans €1 Billion Investment in India, to boost logistics, digital services, and sustainable growth by 2030, focusing on healthcare, e-commerce, and green transport infrastructure. - Loginfo24

NRI News Roundup

NRI Tax Guide for Indian Property Investments, explains key tax duties, TDS rates, documentation, and compliance under IT Act and FEMA when NRIs purchase real estate in India. - Hindustan Times

NRI Foreign Income Tax Implications After Return, depends on the taxpayer’s residential status and income source, with Indian income taxable regardless of status, subject to DTAA exemptions. - Moneycontrol

Opportunity

Germany is betting big on carbon storage technology known as CCS (Carbon Capture and Storage) . Germany cannot meet its 2045 climate neutrality target without capturing CO₂ from industries like cement, steel, and chemicals, sectors where emissions are nearly impossible to eliminate through other means. The new law unlocks a €30-50 billion investment cycle over the next decade, including €14 billion just for building CO₂ pipelines across the country. 1 2

Which Industries Stand to Benefit

The cement industry is the biggest winner. Companies like Heidelberg Materials are already operating carbon capture plants in Europe and building the world’s first fully decarbonized cement facility. German chemical giant BASF is developing carbon capture projects targeting over 1 million tonnes of CO₂ annually. Industrial gas companies like Linde are building the infrastructure to transport and utilize captured carbon. 3 4 5

What This Means for Retail Investors

For individual investors like us, direct investment in carbon storage projects isn’t really possible, these are massive infrastructure plays led by large companies and private pipeline operators. However, there are indirect ways to gain exposure.

Large publicly listed industrial companies incorporating carbon capture into their operations offer the most accessible opportunity. Companies like Siemens Energy (technology provider), Heidelberg Materials (cement), BASF (chemicals), and Linde (industrial gases) are all advancing carbon storage projects. These aren’t risky startups, they’re established players adding carbon storage as part of their long-term sustainability strategy. This is a multi-decade opportunity, not a quick trade, think 10-15 year horizon as infrastructure gets built and scaled globally. 6

Watchlist (IN)

JioBlackRock Flexi Cap Fund caught significant investor attention this week by publishing its maiden portfolio since its New Fund Offer (NFO) that raised approximately ₹1,500 crore. As India’s newest mutual fund house, a joint venture between Reliance’s Jio Financial Services and global investment giant BlackRock.

The portfolio reveal gives us the first real glimpse into how this powerhouse combination plans to deploy investor capital. What stands out is the fund’s diversified approach: it holds 141 stocks across large, mid, and small-cap segments with around 4.5% kept in cash for flexibility.

The management strategy combines BlackRock’s data-driven analytics with local market expertise, aiming to navigate India’s volatility while capturing growth opportunities. Below are the top 5 holdings,

HDFC Bank - 8.9 %

ICICI Bank - 5.4 %

Reliance Industries - 5.2 %

Infosys - 4.1 %

State Bank of India - 3.4 %

Check complete portfolio at Money Control

Until Next Sunday…

As we head into the coming week, Germany’s industrial landscape will be buzzing with some of the world’s most important trade shows. MEDICA, the largest medical B2B trade fair, kicks off in Düsseldorf on November 17, bringing together healthcare innovators from across the globe. Meanwhile, Munich hosts both PRODUCTRONICA (electronics manufacturing) and SEMICON Europa (semiconductor technology) starting November 18.

As always, if you found value in this week’s newsletter, please share it with your friends, family, and colleagues. The best support you can give us is helping spread these insights to others who might benefit from them. Knowledge grows when shared!

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel