#5 - WK44

Markets Pause, Opportunities Emerge

Welcome to Week 44’s newsletter!

On the India front, November 1st marked a busy day with seven financial rule changes kicking in. From allowing up to four nominees on your bank accounts to new Aadhaar update rules, these changes are designed to make our financial lives easier. Paytm’s new UPI facility for NRIs through NRE/NRO accounts is particularly interesting, but Germany is not in the list.

On the business front, we’re seeing interesting moves like Starlink hiring in Bengaluru ahead of its India launch and Nvidia partnering with Deutsche Telekom for a massive €1 billion AI data center in Germany. Meanwhile, Germany continues to grapple with economic headwinds, from its nuclear exit aftermath to companies like Porsche pulling back on EV ambitions.

In this week’s opportunity section, I’m looking at Germany’s booming Buy Now Pay Later sector, while the watchlist features some interesting insights from Singapore’s sovereign wealth fund and their India bets.

Before we dive in, dein weekly is now on WhatsApp!

Follow the channel for announcements, breaking news, and stories that don’t make it to the weekly newsletter.

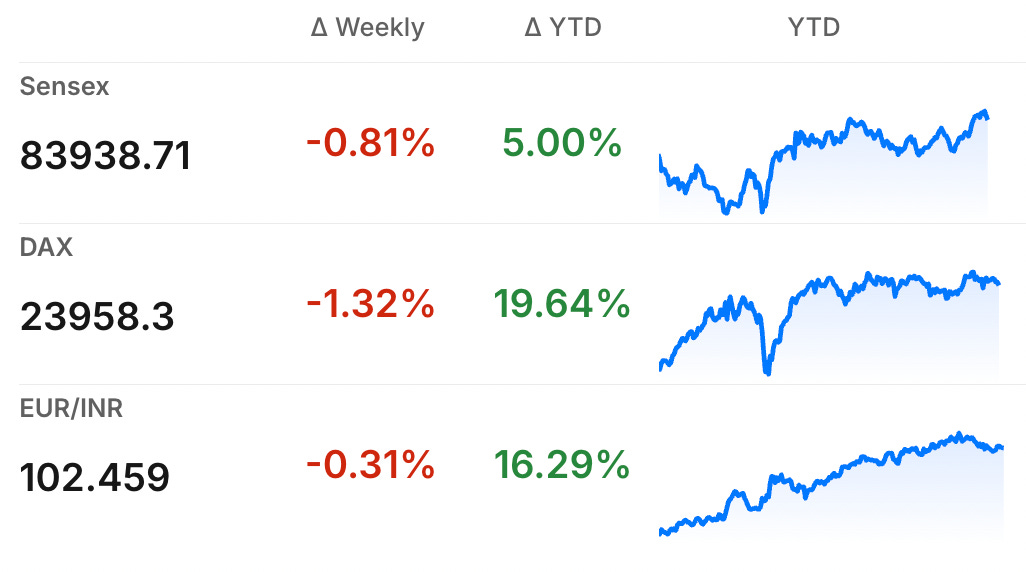

Stock Market

This week in Germany, the DAX had a tough week, dropping from around 24,275 at the start of the week to close at 23,958 by Friday - that’s roughly a 1.3% decline. The German market struggled as investors digested weak economic news and companies like Volkswagen posted their first quarterly loss in five years.

Meanwhile, India’s Sensex also faced headwinds, slipping from about 84,778 on Monday to close the week at 83,938 on Friday, down approximately 1%. Profit booking after recent gains and weakness in healthcare and power stocks pulled Indian markets lower.

Germany News Roundup

Germany Aligns With US, Straining China Ties, recent diplomatic moves under Johann Wadephul threaten decades of economic engagement and risk disrupting trade, technology links, and political dialogue. - Geopolitical Economy

Germany’s Nuclear Exit Devastates Energy and Industry, shutdowns increased fossil-fuel reliance, raised carbon intensity and electricity prices, and caused about a 20% collapse in energy‑intensive manufacturing since 2022. - MacroBusiness

Nvidia and Deutsche Telekom Build €1B AI Data Centre, anchoring a Munich facility with about 10,000 GPUs, hosting SAP as anchor customer and strengthening Europe-first computing to reduce reliance on US and Asian infrastructure. - Tech Funding News

Porsche Pauses EV Push Amid Profit Collapse, citing weak EV demand, China luxury slump and U.S. tariffs, forcing Volkswagen to absorb a €5bn loss and appoint Michael Leiters to lead a turnaround. - DW

Starcar Files Insolvency, 1,100 Jobs Affected, operations will continue while restructuring proceeds, with wages covered through advance state-backed payments, amid heavy debt and a hunt for investors to stabilise the firm. - MeinBavaria

India News Roundup

India Launches 72-Hour GST Auto-Approval System, effective Nov 1, 2025, the digital process will fast-track registrations for most new applicants, backed by risk-based analytics and expanded taxpayer support centres. Source: - India Briefing

India Accelerates Financial Reforms Amid $17B Outflows, authorities are easing listing, foreign fund access, bank lending and capital rules to restore investor confidence, boost credit and widen retail participation over the next 6–12 months. - Economic Times

Starlink Begins Hiring in Bengaluru Ahead of Launch, setting up gateway stations, leasing a Mumbai office, and completing security trials with authorities while targeting commercial service by late 2025–early 2026. - Moneycontrol

SEBI Proposes Mutual Fund Regulation Overhaul, aiming to cut TERs, cap brokerages, exclude statutory levies from expense limits, permit performance-linked charges, and mandate clearer disclosures to ensure investors gain cost savings. - Upstox

Perplexity Adds Indian Politicians’ Stock Holdings, the Finance tool will surface declared asset filings, enable upcoming trade-tracking, and has sparked user debate about accuracy due to common family-held disclosures. - Hindustan Times

Jaishankar Urges India-Germany Cooperation to Stabilise Order, he called for deeper alignment on security, trade and EU negotiations, praising Germany’s support after the Pahalgam attack. - NewsOnAir

Seven Financial Changes Effective November 1, 2025, these include Aadhaar update fees, expanded bank nominations, a new two-slab GST, SBI card transaction charges, revised PNB locker rents, pension life-certificate deadlines, and extended NPS-to-UPS deadline. - India Today

NRI News Roundup

Paytm Enables UPI for NRIs via NRE/NRO, Residents from 12 countries can log in with international numbers to make instant local payments, transfers, merchant QR scans, and avoid remittance delays and forex charges. - Economic Times

NRE Accounts: What Changes After Relocation, if you become a FEMA resident, the bank will redesignate your account and interest will be subject to Indian tax from the day you arrive. - Moneycontrol

OCI Renewal Rules Narrowed for Passport Holders, only one document update is compulsory after turning 20, optional between 21–50, and mandatory for loss, damage, name or nationality changes via ociservices.gov.in. - Economic Times

Opportunity (DE)

Germany’s Buy Now Pay Later (BNPL) market is shaping up as an interesting growth story that’s worth watching. The market is expected to hit nearly $70 billion in 2025 and could reach over $103 billion by 2030. What makes this particularly interesting is how naturally BNPL fits into German consumer behavior - Germans have always preferred invoice-based payments (the traditional “Rechnungskauf”), and BNPL is essentially a digital evolution of that habit.

Companies like Klarna, PayPal, and Ratepay are leading this charge, partnering with major retailers like MediaMarkt, Otto, and Zalando to offer flexible payment options right at checkout. The real momentum is coming from e-commerce integration, where over 60% of BNPL transactions now happen online, but we’re also seeing growth in physical stores like Saturn and IKEA for bigger purchases like furniture and electronics.

What caught my attention is how this sector is diversifying beyond just fashion and electronics. BNPL providers are now expanding into home improvement, healthcare, and even sustainable financing solutions - essentially any purchase where people want to spread payments without the hassle of traditional credit. Young consumers are driving this adoption, with BNPL usage jumping 30% in just one year.

Read more about this at Yahoo Finance

Watchlist (IN)

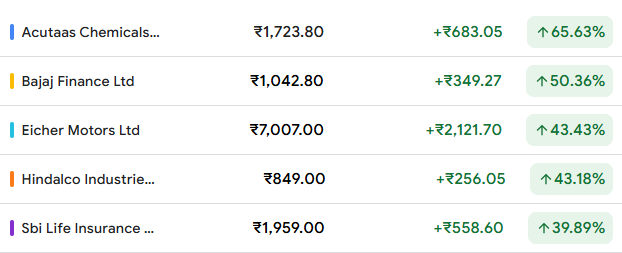

The Government of Singapore’s India portfolio is worth keeping an eye on. It’s essentially a masterclass in long-term investing from one of the world’s most disciplined sovereign wealth funds. They currently hold stakes in 57 BSE-listed Indian companies worth about Rs 2 lakh crore, and what’s interesting is the performance split in 2025 so far. Twelve of their holdings have rallied between 25% to 60%, with standout performers like Bajaj Finance (up 58%), Eicher Motors (up 45%), and Hindalco Industries (up 41%). These aren’t random picks - we’re looking at companies across financials, auto, metals, insurance, and telecom sectors like Bharti Airtel, SBI Life Insurance, and IndiGo (Interglobe Aviation). What makes this particularly relevant is that Singapore typically takes concentrated positions (they hold 2.5% in Bajaj Finance worth Rs 16,704 crore and 3.34% in SBI Life worth Rs 6,612 crore) and holds for the long term.

The flip side is also instructive, not everything in their portfolio is printing money. Stocks like Varun Beverages, Triveni Turbine, and Kalyan Jewellers have dropped 25-42% this year, showing that even smart institutional money doesn’t get it right every time. What this tells is that following sovereign investors like Singapore isn’t about blindly copying their portfolio, but rather using it as a starting point for research. These are quality companies that have passed rigorous due diligence by one of Asia’s most sophisticated investors. For retail investors like us, this list serves as a solid watchlist, particularly those stocks where they’ve increased stakes or maintained large positions through market volatility. Names like Shriram Finance (up 25%, GoS holds 4.73% stake) and Endurance Technologies (up 36%, GoS holds 5.33% stake) are worth a deeper look if you’re building a long-term India portfolio.

Read more at Economics Times

Until Next Sunday…

That’s a wrap for this week! Markets don’t move in straight lines, and neither does life. Some weeks bring gains, others bring lessons, both are valuable if you’re paying attention.

If something in today’s newsletter sparked your interest, dig deeper. That’s where the real value lies, not in knowing everything, but in understanding a few things really well.

Know someone who’d find this useful? Forward this newsletter to them. Good information is meant to be shared.

See you next week with fresh insights. Until then, stay informed, stay invested, and most importantly, stay skeptical of anyone promising easy money.

See you next Sunday,

Jimit Patel

SAP becoming the anchor customer for this Munich AI facility signals a major shift in their AI strategy from just building Joule on top of cloud providers to actually securing dedicated compute. The €1 billion investment and 10,000 GPUs mean SAP is serious about competing with hyperscalers on AI model training rather than just inference. For a German company like SAP, having Europe-first computing infrastructure is strategic, it solves data residency issues that have been plaguing their European custmers for years. The timing makes sense too, SAP needs massive compute capacity to train industry-specific LLMs for manufacturing, supply chain, and finance use cases across their S/4HANA base.