#3 - WK42

Germany Inflation, DeepTech Pact, AP Data Center

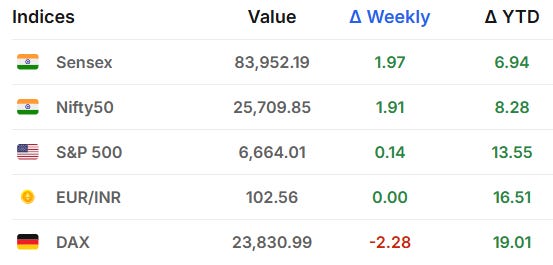

What a week it’s been! While Trump keeps everyone guessing with his tariff threats and the markets are doing their usual dance. This week threw up some interesting contrasts. Germany’s DAX took a beating (down 2.28%), largely because banks and defense stocks got spooked by trade war fears and peace talk rumors. Meanwhile, Indian markets? They just kept climbing! Sensex and Nifty both gained close to 1.9%, with Bank Nifty even hitting fresh all-time highs. It’s fascinating how the same global news can shake one market while barely making a dent in another.

Beyond the stock tickers, there’s a lot happening on the ground in both countries—from Germany’s new tax-free scheme for working retirees to Google’s massive $10 billion bet on Andhra Pradesh. .

Before we jump in, a quick favor: if you’re finding this newsletter helpful, please share it with your network. We’ve crossed 150+ subscribers and every share helps reach more people like you!

Let’s dig into the details.

Stock Market

Germany’s DAX had a tough week, losing 2.28% to close at 23,831 points on Friday. Banking stocks like Deutsche Bank and Commerzbank faced pressure due to concerns around US-China trade tensions and upcoming geopolitical meetings. Defense companies also declined ahead of peace talks. However, auto stocks provided some relief, with Continental jumping over 11% on strong quarterly results

Indian markets had a solid week with both Sensex and Nifty posting strong gains. The Sensex closed at 83,952 points while Nifty ended at 25,710 points both up by close to 1.9%. Bank Nifty hit an all-time high on Friday.

Germany News Roundup

German retirees to earn €2,000 tax-free, boosting economic growth and workforce participation with the Aktivrente scheme from January, allowing retirees to earn tax-free income alongside pensions. - The Guardian

Germany Considers Reinstating Military Service, amid internal government debate, with plans to survey 18-year-old men next year while voluntary enlistment remains preferred by Defense Minister. - DW

Germany’s Inflation Hits 2.4% in September, reaching the highest level in 2025 driven by rising service prices and slower energy cost declines, with inflation expected to stay above 2% through year-end. - News.az

Lidl Owner Invests in European Rocket Startup Hyimpulse, boosting its development of mini carrier rockets to enhance Europe’s satellite launch capabilities and competitiveness against dominant global players. - FAZ

German Defense Stocks Become Bargain Buys, Rheinmetall, Hensoldt, and Renk shares sharply drop despite strong orders and records, prompting investors to reconsider the sector’s outlook during this sudden market plunge. - Bild

Germany plans to invest €10 billion in military and surveillance drones, aiming to strengthen defense capabilities, enhance battlefield intelligence, and reduce reliance on foreign technology amid growing European security challenges. - Fakti

Auto Industry Warns of Production Risks from Chip Supply, due to export restrictions on Dutch chipmaker Nexperia amid US-China trade tensions, causing potential stoppages and global supply chain disruptions. - Tagesschau

Vienna Insurance Group will acquire Germany’s Nürnberger Versicherung, for about €1.4 billion, gaining full control from major shareholders like Munich Re and Swiss Re, as part of its expansion and diversification strategy in the German insurance market. - Reuters

India News Roundup

Google to Invest $10 Billion in Andhra Pradesh, to build a 1-gigawatt data centre, with a formal agreement expected soon between Alphabet and the state government. - Yahoo Finance

Gold and Silver Hit Record Highs Ahead of Dhanteras, driven by global uncertainty, rate cuts, and strong festive demand, prompting safe-haven investments despite potential post-Diwali price corrections. - India Today

Rolls-Royce Partners with Bharat Forge for Jet Engines, to locally manufacture fan blades for its Pearl 700 and Pearl 10X business and regional jet engines, reinforcing ‘Make in India’ and expanding aerospace supply chains. - Time of India

Bloomberg Media Partners with JioTV in India, making global business news and premium content available to JioTV’s 500 million users, enhancing access to Bloomberg’s trusted financial insights across India. - Medianews4u

Tata Motors has officially demerged its commercial and passenger vehicle businesses, to enhance focus, improve operational efficiency, and unlock shareholder value, aligning each vertical with its unique growth, innovation, and market strategy. - Economic Times

India and Germany Launch DeepTech Innovation Pact, to foster AI collaboration and create a joint deeptech hub aimed at enhancing bilateral technological advances and innovation ecosystems. - Business World

NRI News Roundup

Sebi Plans Remote KYC for NRIs, to simplify and digitize the KYC process, eliminating the need for NRIs to travel to India, enhancing ease of investment and market participation. - ET Now

Key Tax Tips for NRIs Returning to India, covering capital gains, rental income tax, TDS compliance, and filing to optimize liabilities on property sale and rent when resettling in India. - Hindustan Times

Opportunity (DE)

ThyssenKrupp’s naval subsidiary TKMS, which specializes in warships and submarines, is listing on October 20, 2025. The timing is interesting—Germany recently announced plans to invest €10 billion in military and surveillance drones, and European defense spending is rising amid growing security concerns. TKMS builds submarines and naval vessels for NATO countries, giving it a strong order book backed by government contracts. The parent company retains 51% control, which signals confidence while allowing TKMS operational independence. For existing ThyssenKrupp shareholders, the 20:1 allocation (one TKMS share for every 20 ThyssenKrupp shares held) adds automatic exposure to this defense pure-play. 1

However, there are considerations. Defense stocks recently took a sharp drop despite strong orders-Rheinmetall, Hensoldt, and Renk all fell significantly, prompting questions about sector valuations. Defense companies face lumpy revenues tied to government budgets and long procurement cycles, making earnings unpredictable. Additionally, geopolitical shifts—like potential peace talks—can quickly dampen investor sentiment, as we saw this week. TKMS could be a solid long-term play if European defense budgets stay elevated, but short-term volatility is likely.

1 - Marketscreener

Watchlist (IN)

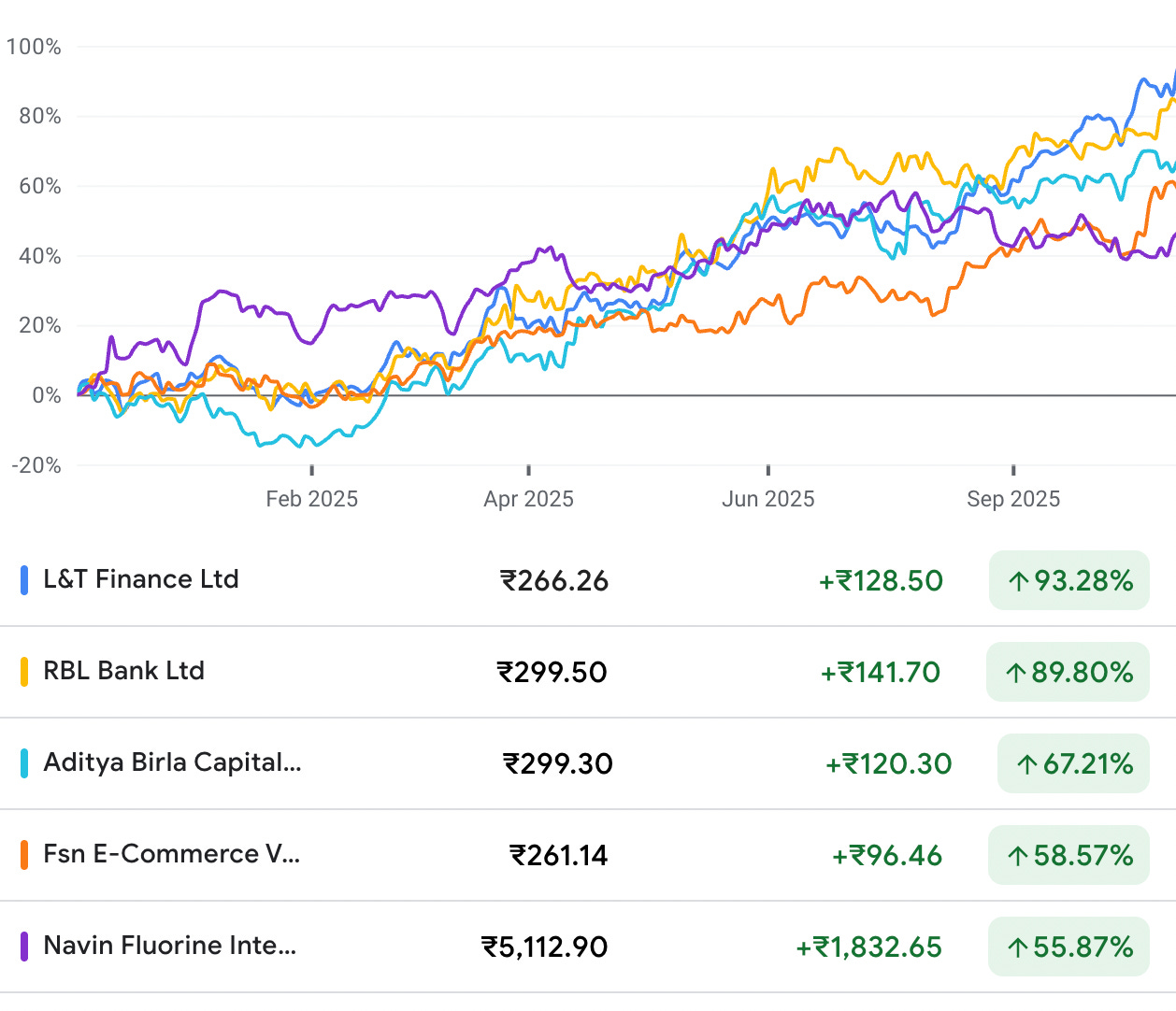

When over 100 mutual fund schemes own a stock, it’s usually a sign of strong institutional confidence. Here are five names that backed by serious money and showing impressive momentum in 2025:

L&T Finance: Surged 94% in 2025 to Rs 266, held by 147 mutual fund schemes with total holdings worth Rs 6,560 crore.

RBL Bank: Rallied 89% to Rs 299, held by 120 mutual fund schemes with equity holdings of Rs 5,085 crore.

Aditya Birla Capital: Gained 67% to Rs 299, held by 142 mutual fund schemes with total equity holdings of Rs 4,980 crore.

FSN E-Commerce Ventures (Nykaa): Climbed 58% to Rs 261, held by 179 mutual fund schemes with holdings valued at Rs 12,765 crore.

Navin Fluorine: Increased 55% to Rs 5,112, held by 146 mutual fund schemes with holding of Rs 4,314 crore.

Source : Economic Times

Gift City

GIFT City Rises to 43rd in Global Finance Ranking, reflecting India’s expanding influence and its status as Asia-Pacific’s only top-15 financial centre with strong innovation and regulatory strength for global players. - Indian Express

Conclusion

That’s all for this week! It’s been quite a journey from DAX struggles to Indian markets celebrating new highs. With Diwali right around the corner, wishing you all a very Happy Diwali! May this festival bring lots of light, laughter, and prosperity to you and your families. If you found this useful, do share it with friends who might benefit. Enjoy the festival, and I’ll see you in the next edition!