#2 - WK41

Ambitions vs Reality - Europe Rethinks, India Accelerates

Welcome to second edition of dein weekly,

What a week it’s been - while the president of the world’s oldest democracy, didn’t quite get the recognition he was rooting for, will German automotive giants get what they are hoping for “renegotiate the aggressive 2035 diesel vehicle ban timeline in Europe” ? It’s fascinating to watch Europe grapple with the reality of its green ambitions meeting industrial pragmatism.

Meanwhile, back in India, the reform momentum continues to roll strong—fresh off the GST 2.0 announcement, the Global Fintech Fest in Mumbai this week brought more exciting developments that signal India’s determination to leapfrog into the digital financial future. Whether you’re tracking European policy shifts or Indian reform stories, this week had plenty to unpack. Let’s start with the market update first.

Stock Market

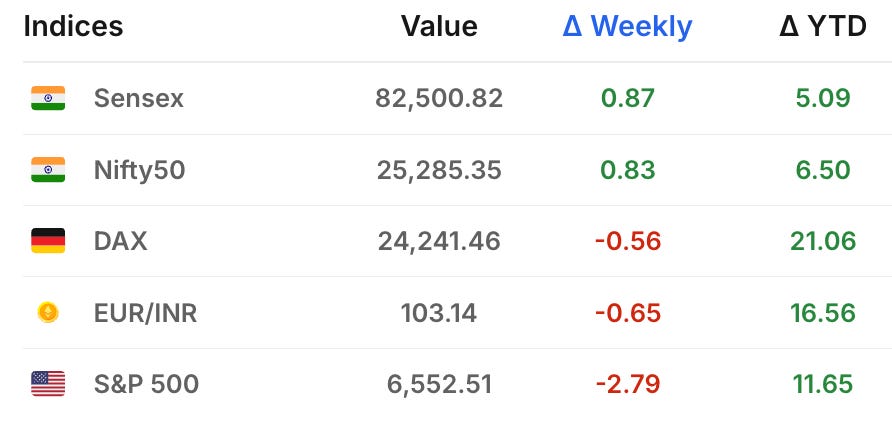

The DAX had a volatile week, briefly touching an all-time high of 24,771 points on October 9th before pulling back sharply. The index closed the week at 24,241 points on Friday, down 1.5% on the last trading day as investors booked profits and defense stocks weakened following Middle East peace developments.

Indian markets showed resilience this week, with both Sensex and Nifty posting their second consecutive weekly gain. The Sensex climbed to 82,501 points while Nifty50 reached 25,285 points, both hovering near three-week highs. Banking, financial services, and realty sectors led the rally.

Germany News Roundup

Germany Extends EV Tax Exemption to 2035, supporting the auto industry amid job cuts and challenges from global competition, with a €600 million revenue impact and ongoing debates on combustion engine bans. - Detroit News

Germany Revises 2025 Growth Forecast Upward, predicting a slight rise to 0.2% growth this year and accelerating to 1.3% next year based on government investment and reform efforts. - ABC News

Merz Urges Germany to Embrace Reform or Suffer Economic Decline, warning that without accepting necessary changes, Germany risks economic decline amid coalition divisions and rising far-right influence. - Detroit News

Germany Launches €6b Industrial Decarbonization Program, introducing carbon capture in climate contracts, targeting energy-intensive sectors with competitive auctions for emission reduction subsidies over 15 years. - Energy Now

Germany’s Tough China Stance Faces Economic Dilemma, Germany’s new leadership adopts a hard line on China amidst internal divisions and increasing economic dependency, risking inconsistent enforcement despite rising pressure from industry and political factions. - CEPA

Tesla Cybertruck Banned in Germany for Safety Issues, due to significant passive safety concerns, Germany has not approved the Tesla Cybertruck for use on its roads, impacting Tesla’s market entry plans there. - Teslarati

Germany Expands 150+ Offshore Centers in India, fueling innovation and growth with 130,000+ professionals in engineering, digital, and business roles to support global R&D and digital transformation initiatives. - Yahoo Finance

India News Roundup

Finance Minister Launches FCSS (Foreign Currency Settlement System) for GIFT IFSC, enabling near-instant local settlement of foreign currency transactions and enhancing GIFT IFSC’s competitiveness among global financial centers. - Moneylife

PayPal CEO Highlights India’s Global Fintech Role, seeing India as a vital market for cross-border payments, talent, and innovation, with strategic focus on connecting India globally, not domestic payments, and exploring fintech startups investment. - Moneycontrol

Zoho Expands Fintech Reach with New PoS Devices, launching integrated payment hardware to unify banking, payments, and business finance for Indian enterprises with plans for local manufacturing. - Financial Express

Anthropic Plans Bengaluru Office Launch 2026, expanding its AI operations with support from Alphabet and Amazon to strengthen presence in India’s tech hub. - Trading View

India’s Data Center Boom Surges Rapidly, fuelled by hyperscalers, AI demand, and global investments, India’s capacity is set to more than double within five years, positioning it as a key digital infrastructure hub. - Vietnam

Qatar Becomes Eighth Country to Adopt UPI, enabling seamless digital payments for over 830,000 Indian residents and tourists. Qatar joins Bhutan, France, Mauritius, Nepal, Singapore, Sri Lanka, and UAE in accepting UPI payments. - Indian Express

NRI News Roundup

Essential Steps for NRIs Moving Back to India, include converting accounts to resident status, reviewing investments, understanding tax obligations, and updating insurance and KYC details for smooth financial transition. - Times of India

GIFT City to Enable Unassisted Face Authentication for NRIs, revolutionizing account opening and transactions for NRIs with easy, instant verification to enhance investment and banking efficiency globally within months. - The Hindu

Opportunities

India’s Digital Payment Goldmine - Who’s Profiting from UPI?

India’s UPI continues its explosive growth, processing over 19.6 billion transactions worth ₹24.90 lakh crore in September 2025 alone. That’s a 31% year-on-year jump in volume, with daily transactions averaging 654 million. UPI now accounts for 85% of all digital transactions in India and has expanded internationally to eight countries, including Qatar this week. The infrastructure is clearly working, and someone’s making money from this digital revolution 1 2

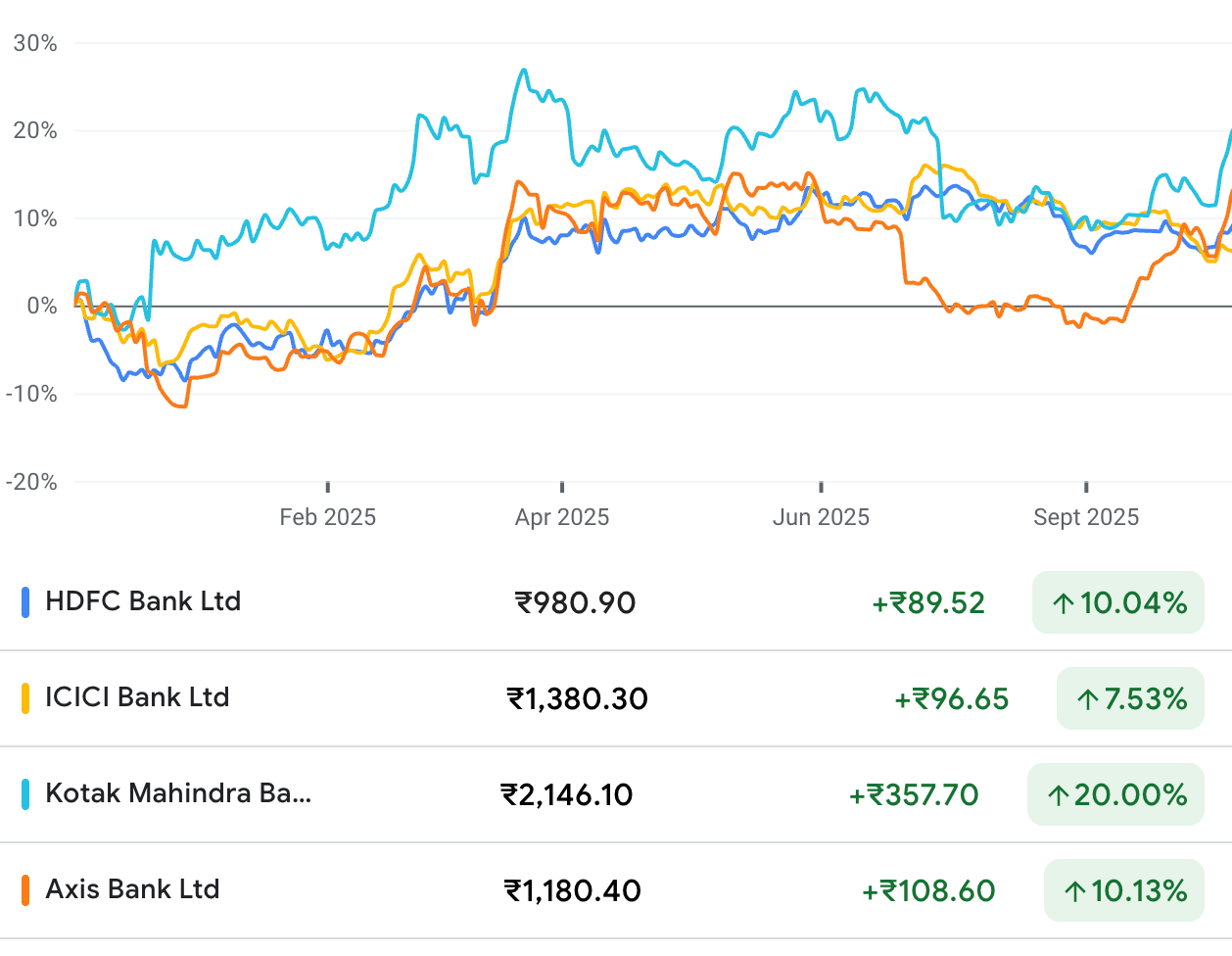

The real winners aren’t the struggling fintech startups—it’s the banks running the backend infrastructure. HDFC Bank, ICICI Bank, Kotak Mahindra Bank, and Axis Bank dominate the UPI ecosystem, handling nearly 60% of all merchant payment processing. These banks earn interchange fees, processing charges, and gain low-cost deposits from UPI users. Their stock performance reflects this, solid returns while benefiting from India’s digital payments boom without the volatility of pure fintech plays. 3 4

1 - gov.in / 2 - IBEF / 3 - Economic Times / 4 - Business Today

Watchlist

Rheinmetall: Analysts See 24% Upside to €2,330

Berenberg Bank just raised their price target for Rheinmetall from €2,100 to €2,330 this week, keeping their buy recommendation. The stock currently trades at €1,882, which means there’s about 24% upside if the analyst target is right. 5

The reason for the upgrade? The company recently acquired new naval assets, expanding beyond their traditional land-based defense business. Twenty analysts are tracking this stock, and most of them are bullish with an average target of €2,244. The stock has had a strong run - it’s already up over 300% from last year’s low—so it’s worth watching if the momentum continues or if we see a pullback. 5

Gift City

As mentioned in news section, GIFT City launched its Foreign Currency Settlement System (FCSS) this week, so let me break down why this matters. Previously, when banks in GIFT City needed to settle dollar transactions, they had to route everything through foreign correspondent banks—a slow process taking 36-48 hours. Now, transactions settle locally in just seconds. This means cheaper costs, faster processing, and less dependency on overseas banking infrastructure.

The new settlement system also boosts liquidity by making more funds available for trading right away. It strengthens GIFT City’s role as a global financial hub, attracting more foreign investors and NRIs by simplifying international payments. This change is expected to make cross-border investing smoother, faster, and less expensive, encouraging more investment flows through GIFT City and supporting India’s global finance ambitions.

Conclusion

That’s a wrap for Week 41!

From German auto negotiations to India’s digital payment boom, it’s been quite a week. If you found this helpful, please subscribe if you haven’t already, and forward this to friends who might benefit from these insights. Your support helps us grow this community. See you next week!