#15 - WK02

A Week of Disruption - Tariff, Storms and Blackouts

What a difference a week makes. Last week, we welcomed the new year with optimism about global markets and fresh beginnings. This week? Reality hit hard, and it came with a hefty price tag.

India’s stock markets tumbled, the Nifty 50 and Sensex both dropped nearly 1.8% in their steepest single-day decline in four months, after President Trump approved a bill proposing tariffs as high as 500% on countries purchasing Russian oil.

Meanwhile, across Europe, winter decided to remind everyone who’s boss. Storm Goretti paralyzed air traffic, with Amsterdam’s Schiphol Airport canceling over 800 flights in a single day and stranding more than 1,000 passengers overnight on field beds. Paris saw 100 flights grounded at Charles de Gaulle, while Brussels and Frankfurt dealt with cascading delays.

Greece got hit even harder, not by snow, but by a mysterious radio communications failure that shut down the entire airspace for hours, grounding around 120 flights at Athens and Thessaloniki as air traffic controllers heard only piercing whistles instead of pilot communications. The cause? Still unknown.

And Berlin? The German capital suffered its longest blackout since World War II, over four days, affecting 45,000 households after a suspected far-left arson attack on power lines during freezing temperatures. The Volcano Group claimed responsibility, targeting what they called the “fossil fuel economy,” though one elderly woman died during the outage.

But here’s the silver lining in this chaos: German Chancellor Friedrich Merz arrives in India tomorrow (January 12-13) for his first official visit, meeting Prime Minister Modi in Ahmedabad to review the 25-year India-Germany Strategic Partnership. The visit comes just ahead of the India-EU Summit on January 27 and focuses on accelerating cooperation in trade, investment, defense, and technology.

This week’s newsletter dives deeper into one particular opportunity emerging from all this European chaos and geopolitical realignment: Ukraine’s reconstruction and the heavy machinery sector that will power it. Read on to discover which German companies are positioned to benefit most.

Stock Market

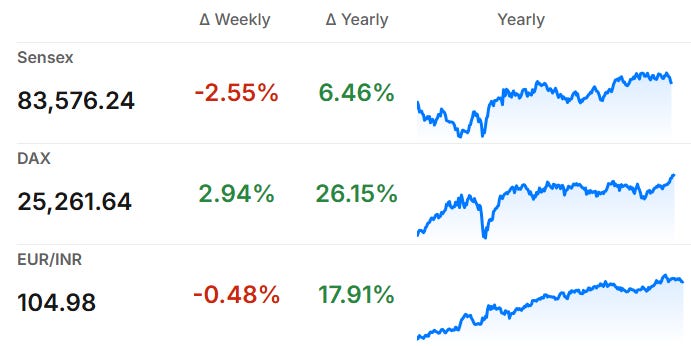

The Sensex had a rough week, closing at 83,576 on Friday, down about 2.5% for the week. This was the worst performance since September 2025. The market faced selling pressure for five straight days due to worries about potential US tariffs on India (talk of up to 500% tariffs on certain goods), foreign investors pulling money out, and concerns about US-India trade negotiations.

The DAX had complete opposite story. It crossed 25,000 points for the first time ever, and continued setting records. It shows hope for German economic recovery in 2026, government plans to spend billions on infrastructure and defense, and defense stocks doing particularly well due to geopolitical tensions.

The Euro is currently trading around 105 Indian Rupees. The rate has been fairly stable this week, moving in a tight range between about 104.85 to 105.58.

Germany News Roundup

Merz Warns of Critical Economic Situation, emphasizing urgent political actions needed in 2026 to boost business conditions and restore growth amid ongoing economic challenges in Germany. - Daily Finland

German Corporate Bankruptcies Hit 20-Year High, reaching 17,604 cases in 2025 with no recovery expected due to ongoing economic challenges, impacting 170,000 jobs amid structural and competitive pressures. - n-tv.de

Unemployment in Germany reached nearly 2.9 million at year-end, marking a multi-year high. Experts predict a modest recovery only by mid-2026, hindered by demographic shifts, structural changes, and economic weakness. - Reuters

Gas Heating Costs to Rise Sharply in 2026, due to significant CO₂ price increases, pressuring households to consider energy-efficient heating alternatives like heat pumps to manage expenses and reduce emissions. - Frankfurter Rundschau

Rheinmetall and MBDA are creating a joint venture, to develop naval laser weapons for ships by 2029. These weapons will use concentrated energy to precisely counter drone threats, though operation is sensitive. - Defense News

Lidl and Kaufland Expand Self-Checkout Usage, leading to concerns over decreasing cash payment acceptance and potential exclusion of some groups, while maintaining traditional cashier options and staff roles. - SWR

Indian Professionals Lead Germany’s Wage Market, earning the highest median salary due to concentration in STEM roles critical to Germany’s economy, reflecting a targeted pattern of skill-based migration rather than nationality bias. - Times of India

India News Roundup

German Chancellor Merz to Visit India in January, to advance strategic partnership discussions covering trade, technology, defense, sustainability, and people-to-people ties during his first visit in 2026. - The Hindu

US May Impose 500% Tariffs on India, potentially affecting Indian exports, energy security, and trade relations due to imports of Russian crude oil under the Sanctioning Russia Act 2025. - Vajiram & Ravi

Sensex Drops 1,500 Points Amid Market Selloff, investor wealth erodes by Rs 9.19 lakh crore due to geopolitical risks, US tariff threats, and declining large-cap stocks, impacting market confidence and broader indices in India. - Times of India

India Issues 72-Hour Ultimatum to Musk’s Grok, demanding action against AI-generated obscene images on X to maintain legal protections amid global scrutiny of AI misuse. - Rest of World

India Advises Against Non-Essential Iran Travel, due to ongoing protests over inflation and currency devaluation, urging caution for Indians currently in the country and advising to avoid protest areas and register with the embassy. - The Hindu

Opportunity

Russia-Ukraine Peace Deal and Reconstruction - Part 2

Engineering and Heavy Machinery

Ukraine’s reconstruction represents a multi-billion euro opportunity for German engineering and heavy machinery companies over the next decade. For investors, this creates potential exposure through specific stocks and sector ETFs.

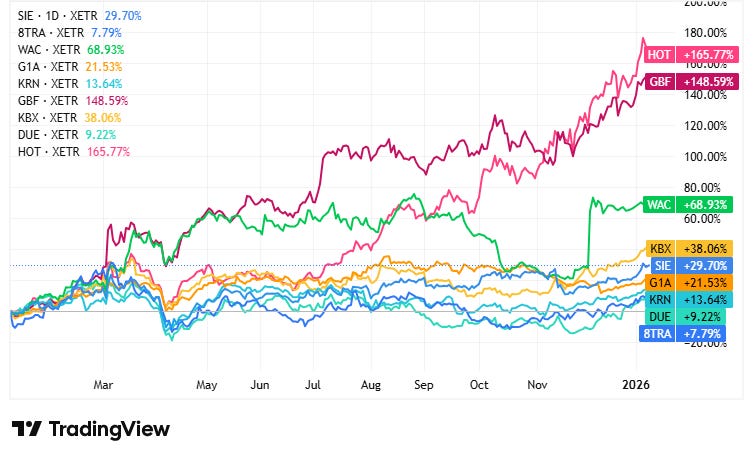

Top German Companies to Watch

Siemens (SIE.DE) stands out with multiple revenue streams: Siemens Energy for grid reconstruction, Siemens Mobility for railway electrification and the European gauge conversion project.

Traton SE (8TRA), owner of MAN Truck & Bus and Scania, offers heavy construction vehicles and commercial trucks essential for infrastructure projects.

Wacker Neuson (WAC) specializes in compact construction equipment, excavators, loaders, and soil compaction machinery crucial for debris removal and foundation work.

GEA Group (G1A) provides industrial process technology and machinery for rebuilding food processing and manufacturing facilities.

Krones (KRN) manufactures packaging, bottling, and process technology systems needed to restore beverage and food production infrastructure.

Bilfinger (GBF) offers engineering services, project management, and industrial maintenance, key capabilities for large-scale reconstruction projects.

Knorr-Bremse (KBX) supplies railway braking and door systems for rail modernization.

Dürr (DUE) provides industrial automation and manufacturing systems for factory reconstruction.

Hochtief (HOT), Germany’s largest construction firm, is positioned for infrastructure mega-projects with existing Eastern European experience.

ETF Options for Diversified Exposure

iShares STOXX Europe 600 Industrial Goods & Services UCITS ETF (EXH1.DE) provides broad exposure to European industrials including many German engineering firms.

Lyxor STOXX Europe 600 Construction & Materials UCITS ETF offers construction materials exposure, though leans away from heavy machinery specifically.

Early movers benefit most. Companies establishing Ukrainian presence now gain specification-setting advantages and preferred supplier status for the peak reconstruction phase (2027-2030). Watch for announcements of Ukrainian representative offices, joint ventures, or reconstruction contracts as positive catalysts.

Until Next Sunday…

This week reminded us that markets don’t move in straight lines and geopolitics rarely takes holidays. Merz’s India visit next week could signal deeper economic ties between Europe and Asia.

Next week, we’ll explore the renewable energy sector’s role in Ukraine’s rebuild and which companies are positioning themselves as green infrastructure leaders.

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel