#13 - WK52

Closing 2025 with SHANTI...

Welcome to Week 52.

Hope everyone had a wonderful Christmas with family and friends!

Speaking of family reunions, this week brought us an unexpected political gathering in Mumbai, Uddhav Thackeray and Raj Thackeray have joined hands for the upcoming civic polls, setting aside years of rivalry.

Back on the policy front, India continues to strengthen its strategic infrastructure. The government’s new SHANTI bill (Streamlining and Harmonisation of Administrative and Nuclear Technology Infrastructure) aims to modernize the country’s nuclear regulatory framework, potentially accelerating clean energy deployment. Meanwhile, the aviation sector received a boost with approvals for two new airlines, signaling confidence in India’s growing travel market as we head into 2026.

Across markets in Germany, we’re seeing significant movements in mid-cap space. Both the MDAX and SDAX indices have undergone notable composition changes this week, reshuffling which companies make the cut in these closely-watched benchmarks. These adjustments often create interesting opportunities as index funds rebalance, more on this in watchlist section below.

Stock Market

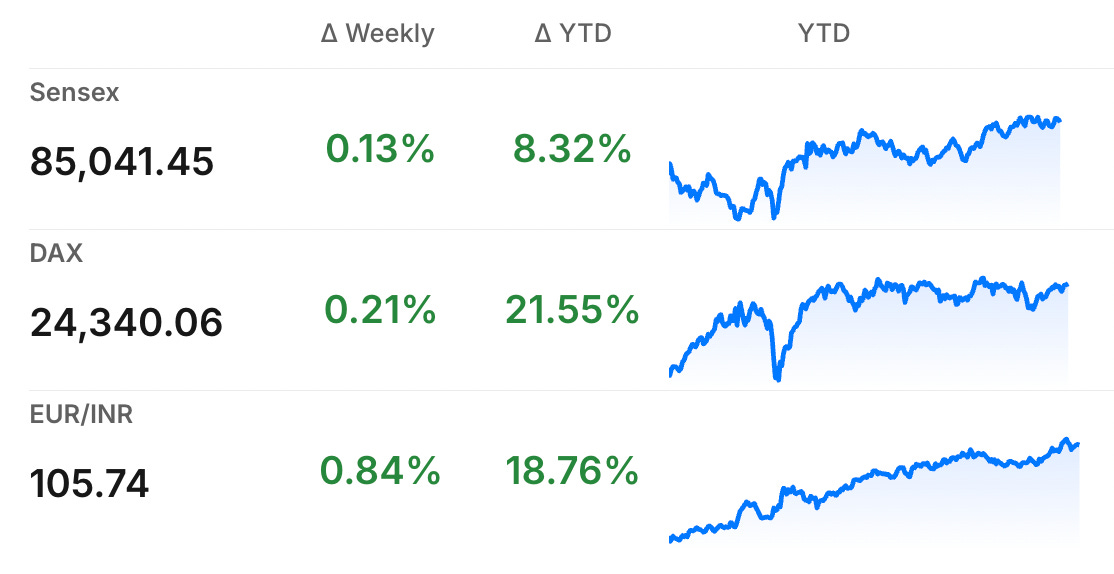

The Sensex had a choppy week, closing at 85,041 on December 26, posting a modest weekly gain. The index showed resilience mid-week, climbing to around 85,600 on December 24, but gave back some gains in the final session, falling 367 points on December 26. Overall, the week saw consolidation with lower trading volumes due to the holiday season.

Germany’s DAX index performed better, climbing to 24,340 by December 23, representing a gain of approximately 0.2% for the week. The index traded near one-month highs, supported by strong US economic data and expectations of Federal Reserve rate cuts in 2026. The Christmas week saw thin trading volumes but steady positive momentum.

The Euro-Rupee pair remained relatively stable, hovering in the 104.92-106.16 range throughout the week. The rupee continues to face pressure from foreign fund outflows, though RBI intervention has prevented sharp moves.

Germany News Roundup

Stuttgart’s Auto Industry Faces Major Crisis, leading to significant job losses, economic deficits, and a potential long-term impact on the region’s prosperity and fiscal stability by 2030. - Stuttgarter Zeitung

Riester Update 2026 Could Return Hundreds, revealing new contract terms that may allow savers to reclaim up to 100 euros monthly depending on their policy details and past adjustments. - Merkur

2025: A Lost Year for German Economy, marked by stagnation, minimal growth, rising insolvencies, job losses, and increased state debt despite moderate consumption and investment declines. - FAZ

Germany’s Export Model Struggles Amid US-China Slump, facing simultaneous demand drops from both the US and China, pushing Germany toward a record trade deficit and urging urgent diversification of export markets and deeper European integration. - Euronews

Germany Faces Economic and Defense Spending Dilemma, Chancellor Merz’s government struggles to balance rising defense budgets with urgent economic reforms amidst growing domestic discontent and far-right political challenges. - ForeignAffairs

EU Imposes €3 Customs Fee on Small Imports, to limit the dominance of Chinese e-commerce on low-value parcels entering the EU from July 2026, ensuring fair competition amid rising imports. - Euronews

Mercedes-Benz to Launch Branded City in Dubai, merging luxury living, retail, and leisure within a vast 9 million sq ft multi-tower development designed as a connected urban district. - DuPont Registry

Samsung’s Harman Acquires ZF’s ADAS Unit, boosting connected car technologies with advanced driver assistance systems and accelerating software-defined vehicle solutions for automakers globally. - SamMobile

2026 German Job Market Winners and Losers, reflect a paradox of rising unemployment despite acute shortages in growing sectors like AI, with ongoing job cuts in manufacturing and challenges for both academics and unskilled workers. - RP-Online

India News Roundup

SHANTI Bill Revamps India's Nuclear Energy Sector, introducing private participation, regulatory reforms, and liability adjustments to boost capacity and efficiency, while execution challenges and timeline uncertainties remain significant. - ORF Online

Two New Airlines Enter India's Aviation Market, but industry experts doubt they can significantly disrupt the dominant duopoly of IndiGo and Air India Group controlling over 90% of domestic market share. - Moneycontrol

India Launches Heaviest Satellite Yet, marking a major boost in its space capabilities and commercial satellite ambitions, with plans for future missions including human spaceflight by 2027. - DW

Aravalli Hills Redefinition Sparks Protests in India, prompting concerns over ecological risks and mining under new Supreme Court criteria that focus on height rather than ecological importance across Rajasthan, Haryana, Gujarat, and Delhi. - BBC News

India-New Zealand Trade Pact Boosts Duty-Free Trade, eliminating tariffs on most goods, enabling $20 billion investment, and promoting skilled mobility, strengthening bilateral economic ties and diversifying India's export markets amid US tariffs. - CNBC

Android’s Emergency Location Service Launches in India, starting in Uttar Pradesh for Android 6.0+ users, helping emergency responders locate callers more accurately during 112 calls without sharing location data with Google. - 9to5Google

Ambani Calls for Stronger Science-Business Integration, to foster innovation in AI, clean energy, and technology-driven solutions benefiting society with empathy and affordability as key principles for India's growth. - Fortune India

Opportunity

Energy Storage

Value Research published an article about clean energy storage, highlighting what could be India’s most overlooked investment opportunity right now. While solar and wind dominate headlines, the real shift is happening in large-scale energy storage. India’s grid wasn’t built for renewable power that fluctuates with sunlight and wind, creating a structural bottleneck where clean energy gets wasted during oversupply periods.

The National Electricity Plan 2023 reveals India needs 16 GW/82 GWh of storage by 2027 and 74 GW/411 GWh by 2032. The government has aligned policy support with transmission-charge waivers and a Rs 9,400-crore scheme for battery storage. Companies like Exide Industries, JSW Energy, Tata Power, and L&T are positioning themselves across battery manufacturing, grid-scale storage, and EPC integration. Storage is becoming the backbone that converts India’s renewable potential into usable electricity.

For more details, read the complete article here.

Watchlist

German Index Reshuffle

Germany’s mid-cap and small-cap indices underwent their quarterly rebalancing on December 22, bringing fresh names into the spotlight while some established players moved down a tier.

The MDAX welcomed two interesting additions. Aumovio, the automotive supplier spun off from tire giant Continental, made it to the mid-cap index just weeks after its market debut. The company focuses on automotive electronics and components. Joining it is TKMS (ThyssenKrupp Marine Systems), the submarine and frigate manufacturer that went public in October.

Making way for the newcomers are Gerresheimer and HelloFresh, both moving down to the SDAX. Gerresheimer, a pharmaceutical packaging manufacturer, has seen its market cap fall below the threshold after a challenging year. HelloFresh, the meal-kit delivery service, also couldn’t maintain its mid-cap status amid operational headwinds.

The SDAX saw even more action. New entrants include Ottobock (prosthetics), Tonies (toy company), Verbio (biofuel producer), and PSI Software, along with the relegated Gerresheimer and HelloFresh. Six companies exited the SDAX: LPKF, Stratec, Thyssenkrupp Nucera, Formycon, Procredit, and Amadeus Fire.

These changes matter particularly for ETF investors who track these indices, as funds must rebalance their holdings accordingly, creating short-term price movements. The DAX, Germany’s flagship index, remained unchanged this quarter.

Read more at Market Screener

Until Next Sunday…

As we close out 2025 and step into the new year, there’s plenty to watch. India’s Union Budget is expected in early February, which could set the tone for fiscal policy and potentially bring clarity on tax structures and investment incentives. Meanwhile, Germany will release crucial inflation data in the first week of January, followed by full-year GDP growth figures mid-month - numbers that could influence ECB policy decisions ahead.

Wishing you all a wonderful start to 2026.

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel