#11 - WK50

Rules, Regs, and Returns

Welcome to Week 50.

This week brought an interesting mix of economic diplomacy, cultural politics, and social regulation. The common thread: governments are trying to redefine the “rules of the game” for trade, for what ends up on our plates, and even for how young people use the internet.

On the economic front, India–US trade discussions moved a step further, with both sides signaling intent to deepen cooperation in areas like manufactured goods, services, and possibly digital trade. For India, any progress here is not just about tariffs; it is about securing better access to a large consumer market and encouraging more investment flows into sectors like technology, manufacturing, and services.

From Washington, the focus shifts to Brussels and Berlin, where Europe is debating something that sounds trivial at first: whether plant-based products should be allowed to use meat-like names such as “veggie sausage.” Behind this, however, is a deeper tug-of-war between traditional farming interests, food industry lobbies, and the growing push towards sustainable and plant-based diets. Germany’s opposition in this debate shows how even a relatively progressive, green-leaning economy can still be protective of its long-standing food culture and agricultural sector.

The week’s regulatory theme continues as we move to Australia, where the government is pushing for tighter controls on teenagers’ access to social media. The idea is to protect younger users from addiction, mental health issues, and harmful content, even if that means strong age-verification rules or outright bans for certain age groups. While this is happening far from India and Germany, similar debates are quietly building up in Europe and even in India, where questions around screen time, online safety, and data protection are becoming harder for policymakers to ignore.

Stock Market

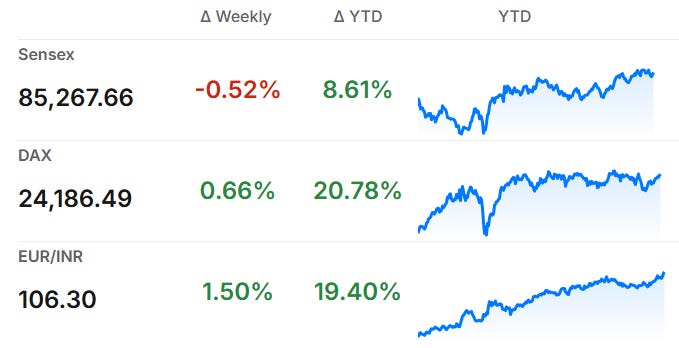

The Sensex hovered around the 85,000–85,300 range and finished the week slightly lower, helped by optimism after the US Fed’s rate cut and earlier RBI rate cut, even though foreign investors were still cautious. Overall, it was a calm, sideways-to-mildly-positive week rather than a big breakout move.

The German DAX index closed near 24,200 and managed to gain about 0.7% for the week, marking its third weekly rise in a row. Tech-related worries pulled it down on Friday, but strength in industrials and exporters helped the index stay in positive territory for the week.

EUR/INR traded between 104.5 and 106.4 this week, with the euro ending a bit stronger against the rupee by Friday.

Germany News Roundup

dm Launches Online Pharmacy Amid Controversy, expanding its digital offerings to include over 2500 non-prescription drugs, sparking concerns from the pharmacy association about safety and market boundaries. - Spiegel

Germany’s Aging Population Accelerates Rapidly, by 2034, one in four Germans will be 67 or older, intensifying pressure on social systems despite high immigration projections. - taz

Germany Plans Syrian Refugee Deportations, mirroring 1980s policies for Turkish migrants amid political pressures and ongoing humanitarian concerns, offering financial incentives for voluntary return but facing limited uptake. - The Conversation

Voith Plans Up to 2,500 Job Cuts, aiming to restructure operations amid high costs and regulatory challenges in Germany affecting about 10% of its workforce through a strategic review. - Yahoo Finance

Thyssenkrupp Steel Plants to Suspend Operations, impacting 1,200 jobs due to cheap imports, with French plant running at half capacity from 2026 amid market pressures and restructuring losses. - GMK Center

Germany Pledges €1.3 Bn for India’s Green Growth, boosting climate, energy, urban mobility, and renewable energy skills through concessional loans under the Green and Sustainable Development Partnership. - Outlook Business

India News Roundup

PM Modi’s Strategic Visits to Jordan, Ethiopia, Oman, to enhance diplomatic ties, explore bilateral cooperation, and address regional and global issues during milestone anniversaries with all three nations in December 2025. - PM India

Rahul Gandhi’s Germany Visit Sparks BJP Criticism, as he plans to attend a major Indian Overseas Congress event in Berlin amid ongoing Lok Sabha winter session, drawing BJP’s ridicule for neglecting parliamentary duties. - Economic Times

IndiGo’s Flight Chaos Hurts India’s Aviation Sector, delays and cancellations triggered by poor planning for new crew-rest rules have stranded thousands and damaged the airline’s reputation and finances. - BBC

Cabinet Approves India’s 2027 Digital Census, planned at Rs 11,718 crore, featuring mobile app data collection, caste enumeration, and generating significant employment opportunities across 30 lakh field functionaries. - PMIndia

Siemens Sells Low Voltage Motors Unit to Innomotics India, for ₹2,200 crore, enabling Siemens to boost cash flow for capex amid market pricing pressures. - ICICIdirect

Amazon Pledges $35B Investment in India by 2030, boosting digital transformation, AI for small businesses, exports to $80B, and supporting 3.8 million jobs as part of India’s growth vision. - Times of India

Microsoft Commits $17.5B to India’s AI Growth, to enhance AI infrastructure, skill 20 million workers, and integrate AI in public platforms benefiting over 310 million informal workers by 2029. - Microsoft News

India Expedites Chinese Business Visa Processing, cutting administrative delays to issue visas within four weeks, signaling improved bilateral ties and renewed economic cooperation. - Bombay Samachar

NRI News Roundup

SEBI Allows NRIs Digital KYC from Abroad, enabling overseas investors to complete re-KYC and KYC modifications digitally without physical presence in India, simplifying compliance and saving travel time. - Cafemutual

Opportunity

Carbon Credits for Indian Landowners

Presented by: minus.global

Carbon credits are essentially certificates that represent the removal or reduction of one tonne of carbon dioxide from the atmosphere. Companies and governments around the world buy these credits to offset their emissions, creating a market where landowners and farmers can earn additional income.

For Indian farmers and landowners, this opens up an interesting opportunity. If you own land you are already doing work that captures carbon from the air. The challenge has always been: how do you measure this, get it certified, and actually sell those credits in the global market? The process involves complex documentation, verification standards, and access to international buyers – things that individual farmers or landowners typically cannot navigate alone.

This is where platforms like minus.global come in, founded by Mehul Khoont, an Indian enterpreneur living in Hamburg. They work directly with Indian farmers and landowners to handle the technical side: measuring carbon sequestration, getting third-party verification, issuing certificates, and connecting sellers with buyers. Essentially, they act as a bridge between your land and the carbon credit market.

The model is straightforward, you continue your sustainable land practices, minus.global handles the certification process, and you receive payment when credits are sold. For landowners looking to diversify income streams carbon credits represent a growing opportunity that rewards environmental stewardship with real financial returns. If you are interested for more information, contact them at contact@minus.co.in

Watchlist

A recent Value Research analysis caught my attention – three mid-cap stocks that turned ₹10,000 into over ₹3.4 lakh in just five years.

HBL Power Systems operates in defense, railways, and telecom sectors with battery and power solutions, delivering 103% annual returns with solid profit growth above 60% per year.

Gravita India, focused on metal recycling and non-ferrous metals, showed similar returns with a strong growth score of 8 out of 10, though cash conversion remains weak.

PG Electroplast, making components for consumer electronics and air conditioners, gave the highest returns at 105% annually, but recently cut its revenue guidance sharply, raising questions about management credibility.

Checkout entire article on Value Research for detailed information.

Until Next Sunday…

As we close out, there are just 12 days left until Christmas. The holiday season is now in full swing across both hemispheres, markets will start thinning out, offices will gradually empty, and the pace of major policy announcements usually slows down as we head into the final weeks of December.

Next week brings a few important events worth keeping an eye on. The US Federal Reserve will hold its final policy meeting of the year, and the European Central Bank is also expected to announce its December rate decision. These are the last big central bank moves before the year ends, and they often set the tone for how financial markets behave in early January. Beyond that, many companies will enter their quiet period ahead of year-end earnings, so expect fewer big headlines and more year-in-review pieces from analysts and commentators.

As always, if you found value in this week’s newsletter, please share it with your friends, family, and colleagues. The best support you can give us is helping spread these insights to others who might benefit from them. Knowledge grows when shared!

Stay informed, stay invested, and see you next week.

See you next Sunday,

Jimit Patel